Some key facts:

- Plumbers Insurance Victoria policy needs to be compliant with VBA requirements

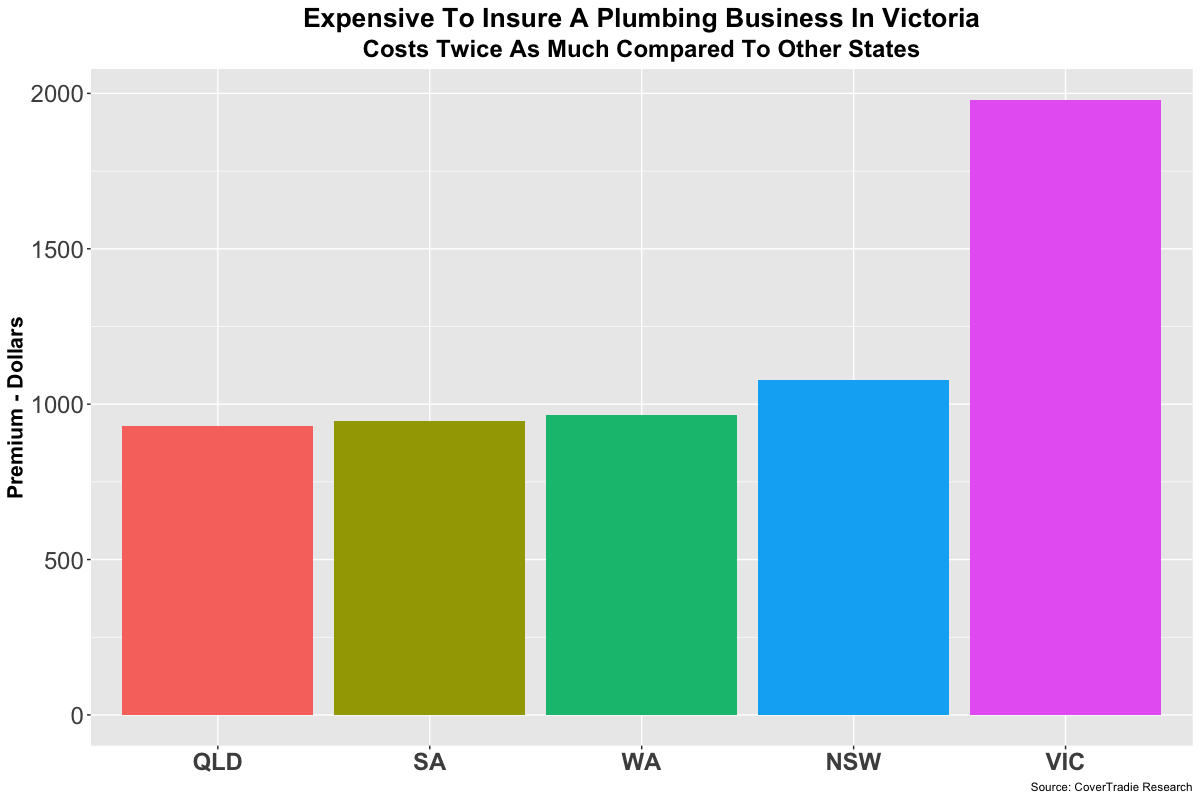

- Plumbers Liability Insurance costs more in Victoria than other common trades

- VBA require specific certificate of currency wording to renew your plumbers licence

- Many insurers are now charging high water damage excess

Plumbers Liability Insurance

Plumbers Insurance Victoria is more expensive in general than Plumbing Insurance in other states. Having said that, an experienced broker knows which insurers are keen to cover plumbers.

We can help you get the right cover should you wish us to sort out your insurance.

Victorian Plumbers Ministerial Order

Back in the day (20th June 2002), the Victorian government prescribed the minimum level of insurance that plumbers are required to have in two Ministerial Orders. You can read the detail here on VBA’s website.

Licensed Plumbers General Insurance Order 2002

Licensed Plumbers General Order, prescribes the minimum insurance required by all licensed persons (except those licensed in Type B Gasfitting). This is the one applicable to most plumbers.

Licensed Plumbers (Type B Gasfitting work) Insurance Order

Licensed Plumbers (Type B Gasfitting work) Insurance Order, which prescribes the minimum insurance required by all persons who are licensed in Type B gasfitting.

Source: https://www.vba.vic.gov.au/plumbing/renewals-other-requirements/plumbing-insurance

Plumbing Licence

Before VBA will issue you a licence or renew your licence, you have to have the right plumbers liability insurance that is compliant with VBA specifications.

Victorian Plumbers Insurance Requirements

You’d need a certificate of currency of your Plumbers Public Liability Insurance which must include:

- The full name of the plumber wanting to have their plumbing license issued or renewed.

- The name of the insurer, the policy number, the start and end date of the insurance policy and;

- The certificate of currency must include the notation:

- “This insurance complies with all the requirements of the Ministerial Order, Licensed Plumbers General insurance Order, dated 20th June 2002”, or, in relation to Type B Gasfitting,

- “This insurance complies with all the requirements of the Ministerial Order, Licensed Plumbers (Type B Gasfitting work) Insurance Order, dated 20th June 2002.

Victorian Plumbers Consumer Protection Cover

Its not going to take much effort to understand that all these requirements about plumber warranty are to protect the consumer.

In our experience, even the slightest variation of wording between what the insurer has written on the certificate versus what VBA want has had plumbers running back and forth between brokers and VBA to fix stuff and trying to renew their plumbers licence.

We can organise the right insurance policy that complies with VBA requirements

Plumbers Insurance Victoria Cost

The price of plumbers insurance in Victoria is more expensive than other states. We have a very good understanding of how to get you the most competitively priced insurance that provides the cover you need.

This also includes the Victorian Plumbers Warranty Insurance Scheme extension. Make sure you check that you have this extension on your policy before you make a purchase.

The cost does go up if you require higher limits on your liability coverage. For example if you were working with large commercial organisation as their subcontractor, they would most likely ask for a $20 million limit which means higher premium!

The table below shows the lowest, average and higher prices for plumbers insurance in Victoria that we came across for a business with turnover of $100,000.

| Limit | Lowest | Average | Highest |

| $5 Million | $ 1,242 | $ 1,682 | $ 2,118 |

| $10 Million | $ 1,605 | $ 2,004 | $ 2,416 |

| $20 Million | $ 1,980 | $ 2,283 | $ 2,750 |

It’s easy to see that there is a huge variation between the cheapest, average and the highest premiums we have observed.

So what drives such a huge variation in the pricing?

There are a few factors that insurers consider to price a particular occupation. Different insurers give different level of importance to these factors, some of which we list below:

- Is there any consumer protection legislation for your trade that results in higher claim volumes, which increases insurance costs

- Your occupation risk – not all trades carry equal risk

- Business activities within your occupation – not all business activities carry equal risk

- Size of your business – higher turnover and staff count usually means higher risk of claims

- The market factors in a particular state, competition etc.

Does the premium increase as your business grows?

As your business size grows say the turnover has increased from $100,000 to say $300,000, you are likely to have a greater number of people working for you.

You may also be sub-contracting work out to other plumbers or trades. Usually this situation can lead to greater number of claims because quality controlling someone else’s work requires processes.

Many times though in the early stages of growth, the lack of controls in business can lead to oversight and mistakes which subsequently lead to claims.

Insurers know that from the data. They price it accordingly. So yes, the price of your insurance is likely to go up as the size of your business grows. See chats below:

You can’t control what insurers think and how they price insurance. You can select a good insurance broker that will save you money and get you the right cover.

CoverTradie is a specialist insurance broker for tradesmen. If we can be of help to you, please give us a call. If you found this article useful, please consider sharing it on Facebook to help us get the word out.

Insurance Types