Personal Accident Insurance

Trades & Construction workers have the highest rate of workplace injuries out of all occupation groups in Australia. Is that a problem? Yes!

- Not everyone is covered by work cover

- Not every injury or illness is covered by work cover

- Injuries & illness can result in loss of income and financial trouble

CoverTradie helps people get the right insurance that protects your cash flow if you got injured or sick.

With CoverTradie you get

Solid Insurance Cover

Get peace of mind that you & your family are well covered

Affordable Pricing

Save money for the new ute, boat or for financial investments

Great Service

Professional insurance work, done quick and explained in plain English

Getting insurance with CoverTradie is as easy as…1,2,3

Quick Phone Call

No Forms to Complete – We do that for you

Get Your Options

We do the heavy lifting of finding the right insurance for you

Pay And You Are Done

Monthly or Annual Payment Options

Frequently Asked Questions (FAQ)

What is Personal Accident Insurance?

Personal Accident Insurance provides cover for your weekly salary if you suffer an accidental injury or sickness (optionally) that results in you being unable to work. In simple terms, it replaces your income if you are unable to attend your occupation.

Some events that can be covered by Personal Accident Insurance are:

– temporary total or temporary partial disablement as a result of accident or sickness

– accidental death

– accidental permanent disabling injury

The technical name in the insurance industry for this cover is Personal Accident and Sickness Insurance. Many people also call it Personal Accident and Illness insurance. Don’t worry, it’s the same thing. It’s important to learn what the key benefits of this insurance are:

– Much cheaper option compared to traditional income protection insurance

– Suitable for Tradespeople

– Easier underwriting and no medical tests

How does Personal Accident Insurance work?

Personal Accident Insurance works to replace your weekly income should you get injured or sick(optionally) and are unable to work. To understand, let’s consider an example:

Mr Handyman earns about $2,000/week (pre-tax) working in the local suburbs for real estate property managers tightening door hinges, replacing tap washers and the likes. He’d like to cover his income for $2,000/week should he get injured and unable to work. He takes up Personal Accident and Sickness Insurance policy covering accident only.

He was presented the option to insure for sickness too, but he declined, he feels he is in good health, young and doesn’t do any work that exposes him to any nasty things that may make him sick so no point paying the extra premiums for this optional coverage.

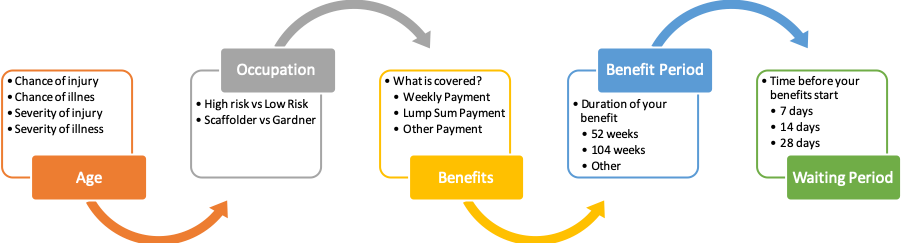

Insurers use the information provided by customers to assess their risk. Age of the customer and the occupation of the customer has a big influence on the pricing. Think about the risk difference between a Handyman vs a Roof Tiler. There is a much higher chance of a Roof Tiler to take a big fall and get seriously hurt.

Similarly, age of the customer plays a big role. Inexperienced young people may have a higher chance of an injury but a faster rate of recovery whereas older more seasoned workers tend to be more careful, hence less frequent injuries but if they do get hurt there is a longer recovery period for them, stretching out the benefits paid to them.

Add to the mix now the Benefits, the duration of Benefits and the waiting period etc. which then determines the price you pay and what you get in return.

Higher benefits and longer benefits period increase the price of personal accident insurance and a longer waiting period reduces the prices of personal accident insurance.

Like every other insurance, the payouts are subject to some terms and conditions that everyone should be aware of, like:

Pre-Existing Medical Conditions: Usually no cover for any claim that arises directly or indirectly due to a Pre-existing Medical Condition unless the insurer has specifically agreed to extend the cover as specified on your policy schedule.

Participation in Dangerous Activities: Usually no cover for claims that arises directly or indirectly due to Dangerous Activities unless the insurer has specifically agreed to extend the cover as specified on your policy schedule. Dangerous Activities are like:

– Caving

– Diving deeper than 30m

– Horse-riding

– Martial arts etc.

As you can appreciate this is no way a complete list and if you’d like to check if something is considered a dangerous activity or not, please give us a call.

General Exclusions: Every policy has some general exclusions. For example, self-harm or suicide, reckless acts, misconduct or any illegal or criminal acts are not covered by insurance policies. There are other exclusions too which you need to be aware of.

What does Personal Accident Insurance cover?

Personal Accident Insurance covers weekly and lump sum payments. Some of them are listed below. Please note that this is just an indicative list and not a comprehensive list. Different insurers may have less or more benefits than those mentioned below.

Weekly Benefits

– Weekly Benefit for Accidental Injury (Mandatory)

Provides cover for your weekly salary if you suffer an accidental injury that within twelve months directly results in you being temporarily disabled and unable to attend your occupation.

– Weekly Benefit for Sickness (Optional)

Provides cover for your weekly salary if you suffer a sickness that directly results in you being temporarily disabled and unable to attend your occupation

– Weekly Benefit for Spouse/Partner Care

Provides cover for your spouse/partner’s weekly salary where they have ceased permanent employment and no longer earning a salary because they are providing you with full time care whilst you are receiving a payment for Weekly Benefit for Accidental Injury or Sickness

– Weekly Benefit for Fixed Business Expenses

If you are a self-employed, this benefit may be available to you. It covers your Fixed Business Expenses whilst you are receiving a benefit paid for accidental injury.

Lump Sum Benefits

– Coma Benefit

Provides a lump sum payment due to you being in a coma for a number of days or more due to an accidental injury.

– Lump Sum Benefits – Specified Events

Provides a lump sum payment due to an Accidental Injury

– Lump Sum Benefits for fractured bones

– Lump Sum Benefits for Loss/Damage to Teeth

Other Benefits

There are a range of other benefits available. Please give us a call to discuss.

Which insurers do Personal Accident Insurance in Australia?

Personal Accident Insurance is done by many insurers in Australia including QBE, Allianz, Zurich, Suncorp, CGU and a host of other underwriting agencies. CoverTradie has strong working relationships with all and can provide high quality insurance at very affordable pricing.

Is Personal Accident Insurance tax-deductible?

The premiums you pay for Personal Accident Insurance are usually tax deductible because if you received an income benefit from your insurance, that is usually taxable. We are only providing general advice here as we are not taxation experts. Your tax accountant should be able to confirm if this is correct or not for your particular circumstances.

Is Personal Accident Insurance the same as Income Protection?

Yes and No. Personal Accident Insurance is similar to Income Protection Insurance because it replaces your income but its not exactly the same. There are some big differences:

– Income Protection Insurance comes under the Life Insurance segment of the insurance industry where as Personal Accident and Sickness Insurance come the General Insurance segment.

– The benefit period of Personal Accident Insurance is usually much smaller, say 52 – 104 weeks depending on the insurers. Income Protection Insurance can provide benefits for your entire working life up to 65years.

– Duration of Cover – One of the key differences between these policies is the Personal Accident policies are cancellable by insurer. For example if you started the policy as a Handyman and then your occupation changed to a much riskier occupation, the insurer can decline a renewal whereas Income Protection policies have a guaranteed renewal.

– Underwriting – Personal Accident Insurance is a simpler version, as a result you don’t require any medical underwriting which makes premiums much more affordable and that leads us to the next point.

– Cost – the premiums for Personal Accident Insurance are significantly lower compared to Income Protection Insurance.

Essentially, Personal Accident Insurance is a lightweight product with much less stringent underwriting process compared to Income Protection Insurance. All of this is a very generic piece of information not meant to be any advice. If you’d like proper advice, we can refer you to a qualified life insurance advisor.