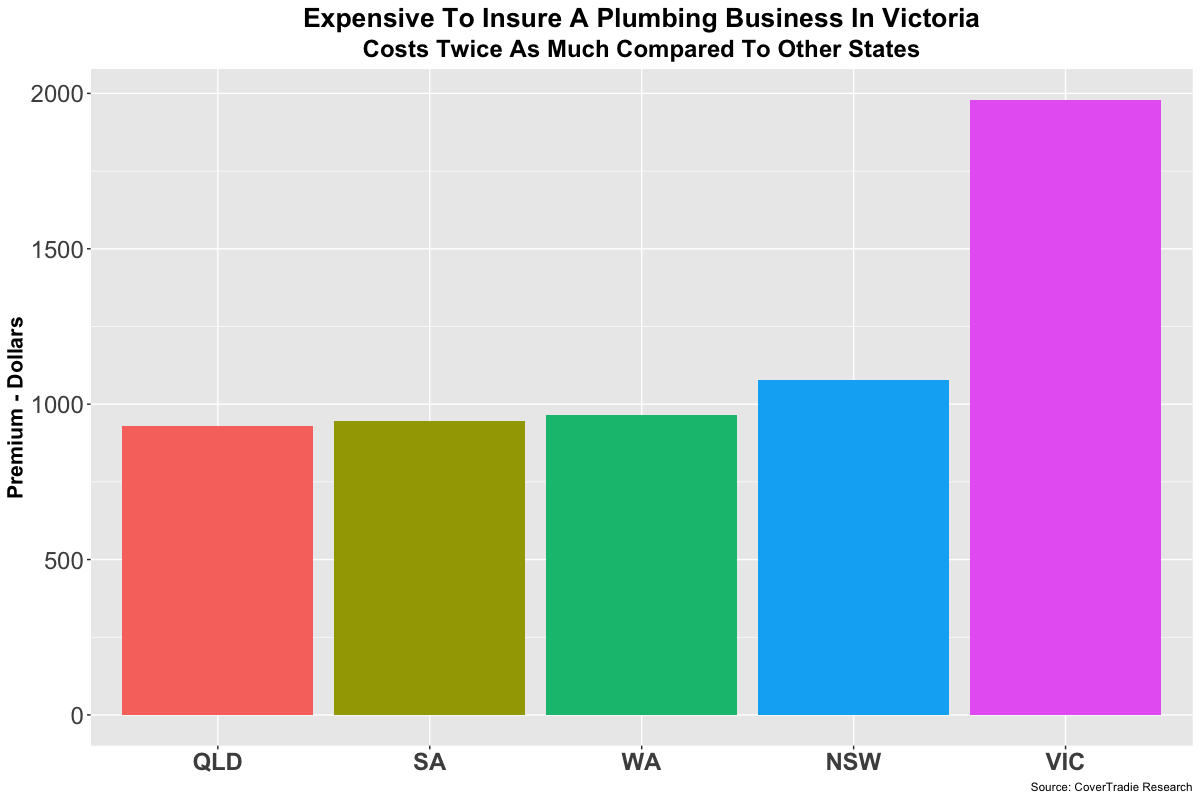

Plumbers in NSW don’t have to pay as much as their Victorian counterparts. They still pay a little more than plumbers in other states though.

Its important to get your plumbing insurance sorted out correctly because not all insurance companies treat all occupations equally.

The prices and exclusions vary a bit between insurers which creates the opportunity to get a policy that suits your business and at a price that is fair.

Having said that, many still continue to make the wrong purchase because:

- Their broker didn’t know which insurer was offering the best price for their insurance

- They took advice from a mate who recommended somebody they knew

- Their bookkeeper put them on to their “insurance broking mate”

- Believed the story that all trades are a high risk and accepted high premiums are okay

- Got advice from a generalist and not a specialist in trades.

CoverTradie’s experience will help you understand the “ins” and “outs” of Plumbers Insurance in NSW so that you can make the right choice when getting your Plumbers Insurance.

Plumbers Insurance NSW Cost

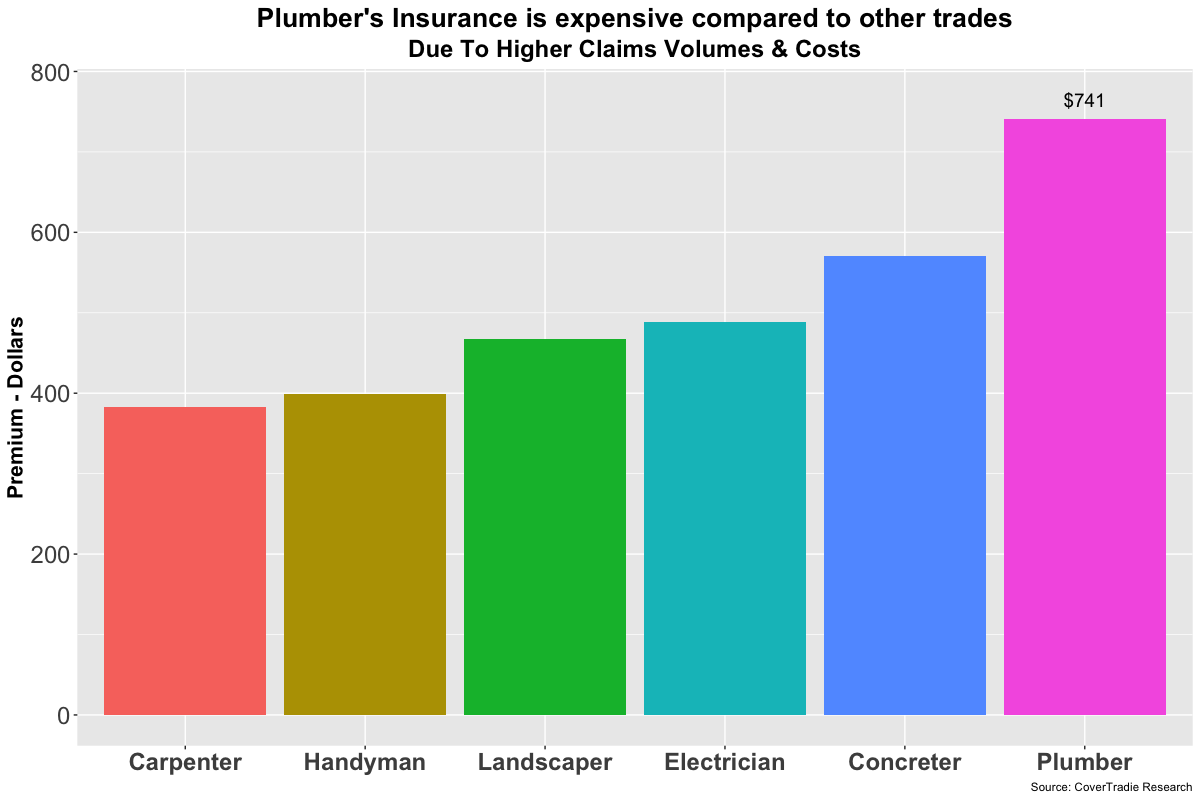

Even though the cost of Plumbers Insurance in NSW is lower compared to Victoria, it is important to note that it is still higher than other common trades. See below:

You can easily tell, how cheap insurance is for some of the other trades compared to Plumbing. And this is a comparison of the cheapest quotes we saw, not the average.

The average prices are actually higher as you’d expect and that’s where the opportunity is to save some money which we share in the table below:

| Cheapest | $ 741 |

| Average | $ 1,412 |

| Highest | $ 2,712 |

The reality is that there is a lot of variation in pricing amongst different insurers. Some would absolutely love to take on Plumbers and others haven’t had a good experience hence they charge a lot more.

Also key to note is that the cheapest insurance mayn’t be the best deal due to the exclusions in it.

You want to be totally sure that the policy has not not been rendered useless with bucket loads of exclusion. No point getting a cheap policy there.

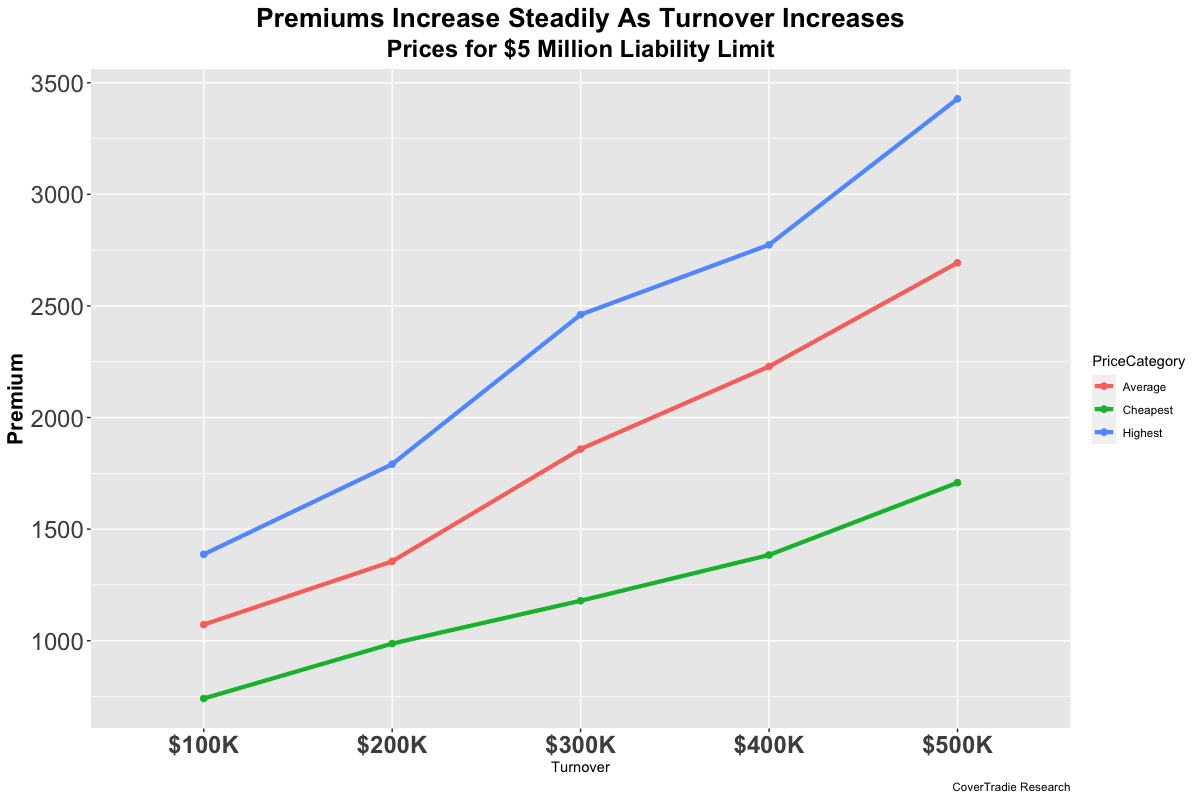

The price of plumbing insurance in NSW starts from about $62 per month for a small business with a turnover of $100,000. This should get you an insurance policy providing $5 million public liability coverage.

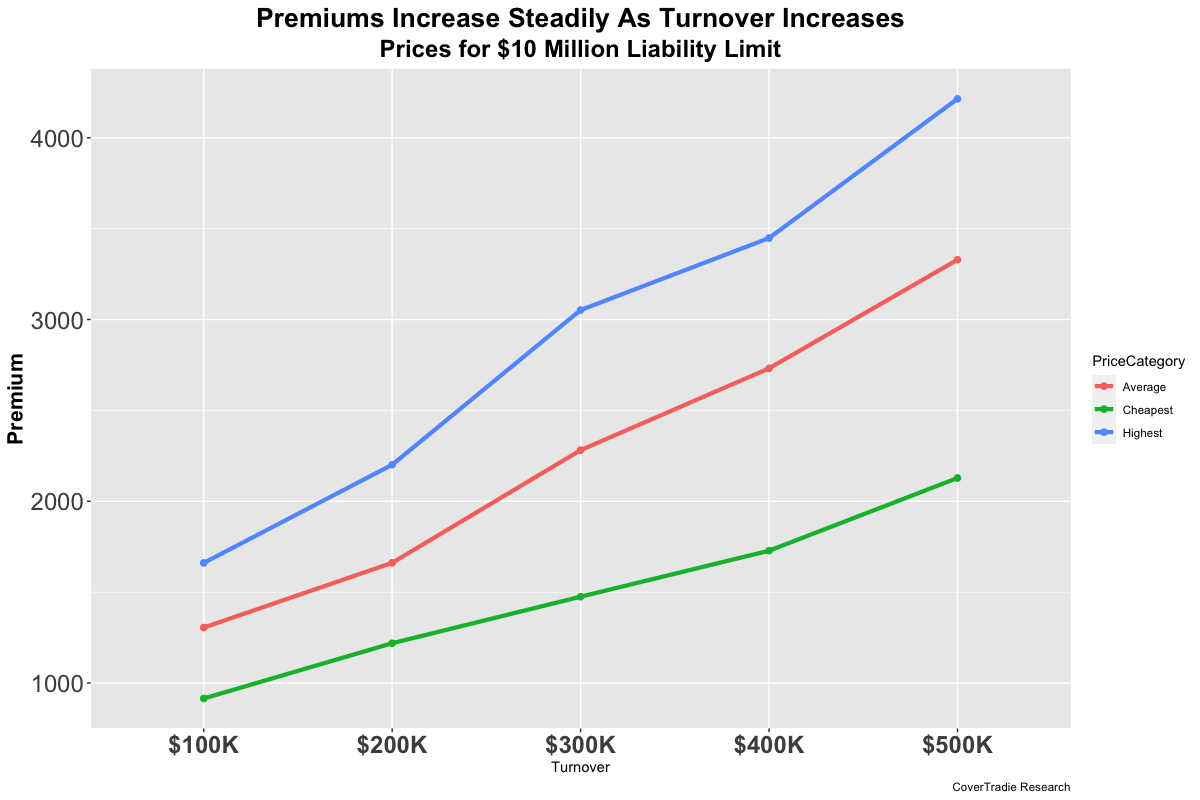

The prices increase if you need higher limits on your liability coverage.

Many start with the $5 million limit but then end up getting higher limits as they start to take on bigger jobs and working with other larger businesses.

Its almost guaranteed that if you were working with large commercial organisation as their subcontractor, they would most likely ask for a $20 million limit which means higher premium!

The table below shows the lowest, average and higher prices for plumbers insurance in NSW that we came across for a business with turnover of $100,000.

| Limit | Cheapest | Average | Highest |

| $5 Million | $ 741 | $ 1,072 | $ 1,387 |

| $10 Million | $ 915 | $ 1,305 | $ 1,661 |

| $20 Million | $ 1,077 | $ 1,795 | $ 2,712 |

It’s easy to see that there is a huge variation between the cheapest, average and the highest premiums we have observed.

So what drives such a huge variation in the pricing?

There are a few factors that insurers consider to price a particular occupation. Different insurers give different level of importance to these factors, some of which we list below:

- Is there any consumer protection legislation for your trade that results in higher claim volumes, which increases insurance costs. This isn’t applicable in NSW but applies to Plumbers in Victoria and Electricians in QLD.

- Your occupation risk – not all trades carry equal risk

- Business activities within your occupation – not all business activities carry equal risk

- Size of your business – higher turnover and staff count usually means higher risk of claims

- The market factors in a particular state, competition etc.

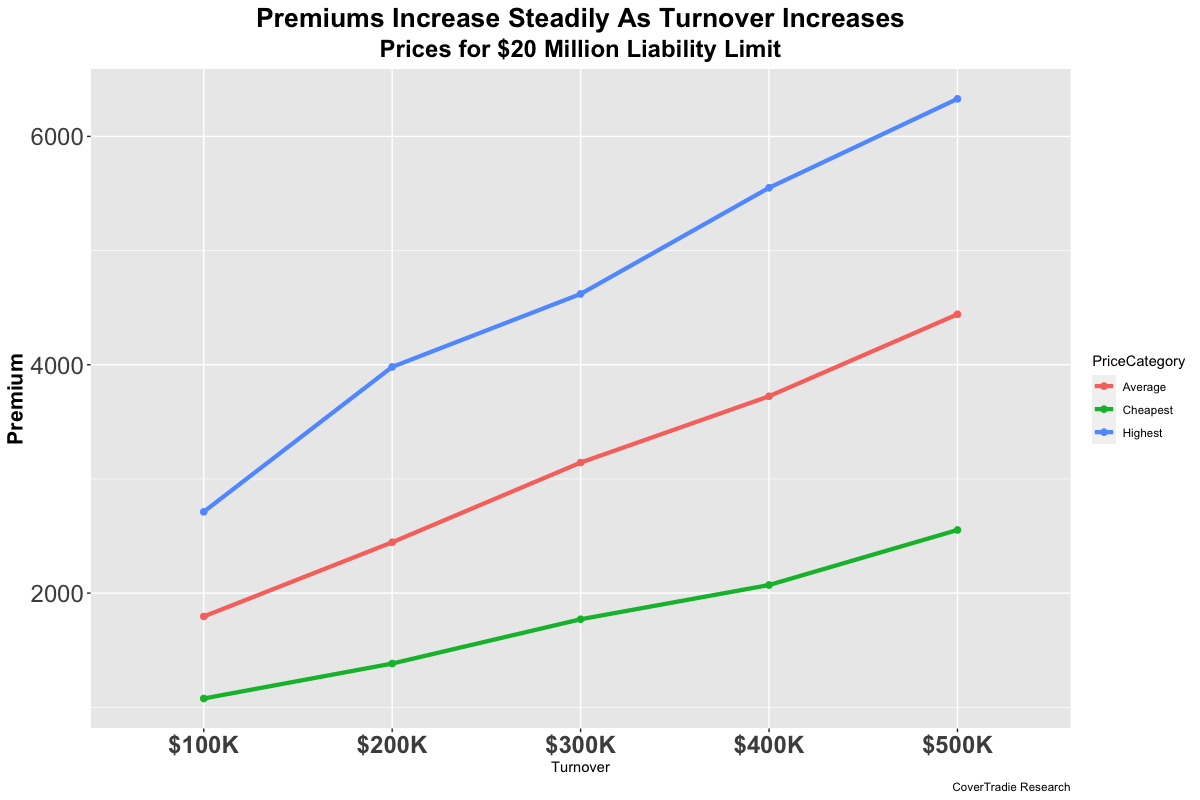

Does the premium increase as your business grows?

Say your business has expanded and has a turnover of $400,000 compared to a $100,000 when you first started. You can surely expect the premium to increase because there’s a higher risk in your business now.

You perhaps now have an apprentice working for you. There are many instances where claims have occurred due to unsupervised work completed by apprentices.

You may also be sub-contracting work out to other plumbers or trades. Usually this situation can lead to greater number of claims because quality controlling someone else’s work requires processes.

Many times though in the early stages of growth, the lack of controls in business can lead to oversight and mistakes which subsequently lead to claims.

Insurers know that from the data. They price it accordingly. So yes, the price of your insurance is likely to go up as the size of your business grows. See chats below:

You can’t control what insurers think and how they price insurance. You can make a choice of insurer and your broker. That will save you money.

So, select a broker who knows what they are doing so they can help you get where you want to – FASTER.

CoverTradie is a specialist insurance broker for tradesmen. If we can be of help to you, please give us a call. If you found this article useful, please consider sharing it on Facebook to help us get the word out.

Insurance Types