Insurance industry thrives on keeping things complex and confusing, how else would customer pay more for their insurance?

You know what? There’s NO NEED.

Keep in mind:

- Good insurance starts around $439 for 12 months or around $40 per month.

- Plenty of insurers to chose from, all wanting your business.

- The benefit a specialist broker that works for Trades not just every occupation.

CoverTradie’s knowledge has helped many and now you can benefit also. You just need the right insurance that saves money and prevents claim time headaches.

Getting insurance with CoverTradie is as easy as…1,2,3

Quick Phone Call

No Forms to Complete – We do that for you

Get Your Options

We do the heavy lifting of finding the right insurance for you

Pay And You Are Done

Monthly or Annual Payment Options

There’s no point lining up the pockets of insurers who charge too much for Electrical Contractor Insurance in WA.

We’ve come across customers that are happy to keep paying higher premiums because someone recommended a particular insurer to them.

They mayn’t have done much research into this all.

We’ve done it, in fact that’s our job. We can tell you that other than minor variations in exclusions which can easily be managed, by and large the insurance policy wordings are very similar.

It is such a regulated industry that the insurers can’t get away with charging you money for selling insurance that won’t cover.

So what does that mean?

Most insurance policies are good and will cover you provided you have checked they have not snuck in a cheeky little exclusion. But that’s our job to do.

We read the exclusions for you so you don’t have to.

That leads us to the other point, If you are reading this, chances are that you have two questions in your mind?

- What insurances do I need to be an electrician?

- How much is insurance for an electrical contractor?

You can read about our detailed article here where we have gone into the details that talk about Electrical Contractors Insurance in general.

In this article, we have focussed on the Electrical Contractors Insurance Cost in WA.

Public Liability Insurance

Chances are that you would be allocated a job if your head contractor or your direct client has seen the certificate of your public liability insurance.

What is Public Liability Insurance?

Public Liability Insurance protects you against a financial loss if, your business activities cause a damage to someone’s property or injury to a person or even their death.

For electricians it could mean:

Say you have been asked to do the wiring of a new motor vehicle paint shop. You’ve tested it all and given a compliance certificate only learn from the shop owner a few days whilst you are away on holidays overseas that there’s sparking every time they turn on their high load compressors.

They need to get emergency make safe repairs, re-do the wiring and have a bill ready for you to pay when you return from the holidays.

Your customer demands those costs are covered by you and you would reach out to your Public Liability Insurance provider.

Without this insurance, you can’t really trade, its mandatory that you have at least $5Million dollar coverage which really only startup guys take up.

Whether you need $5Million, $10 Million or $20 Million coverage, will most likely depend on the type of jobs you do and who you work with.

If you work as a subcontractor to a large business, they probably will ask for a $20 Million limit.

What is the cost of Electrical Contractors Insurance in WA?

The cost of Electrical Contractors Insurance in WA starts at $439 for the year or about $40 per month. That is for a small business with turnover of $100,000 on a $5 Million liability limit.

Obviously, the premiums are going to be different for tradies with varying circumstances like:

- How big is your business? Turnover of $100,000 or $500,000 or more?

- Location/State

- Activities – The type of work you do has an impact. Domestic, commercial and industrial type of electrician work presents different risks. Some underwriters charge differently for it.

- If there are previous claims – just like car insurance goes for people who make frequent claims, so does business insurance.

- Level of cover etc. – $5Million coverage or $50 Million?

Let us see some actual numbers:

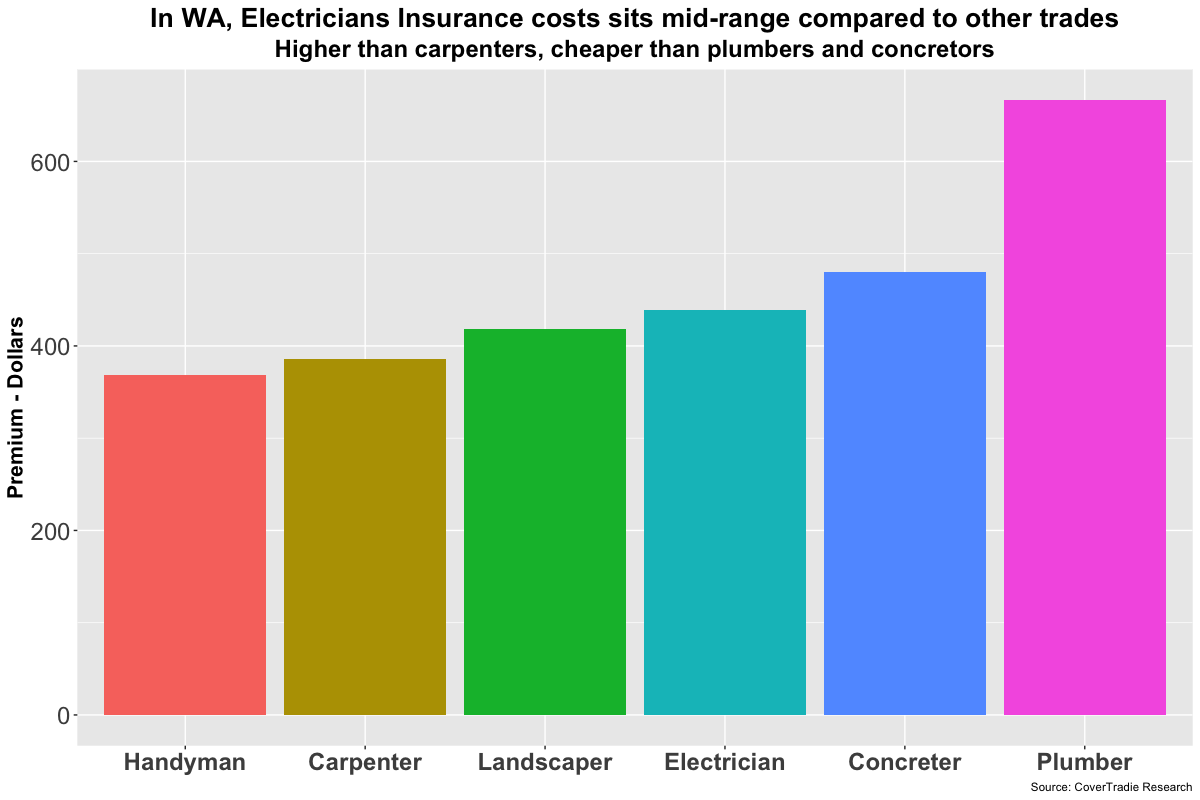

First of all, how does the insurance pricing for electrical contractors compare with other common trades in WA. See chart below:

Not only that, the insurance for Electrical Contractors in WA is cheap compared to your electrician colleagues in other states.

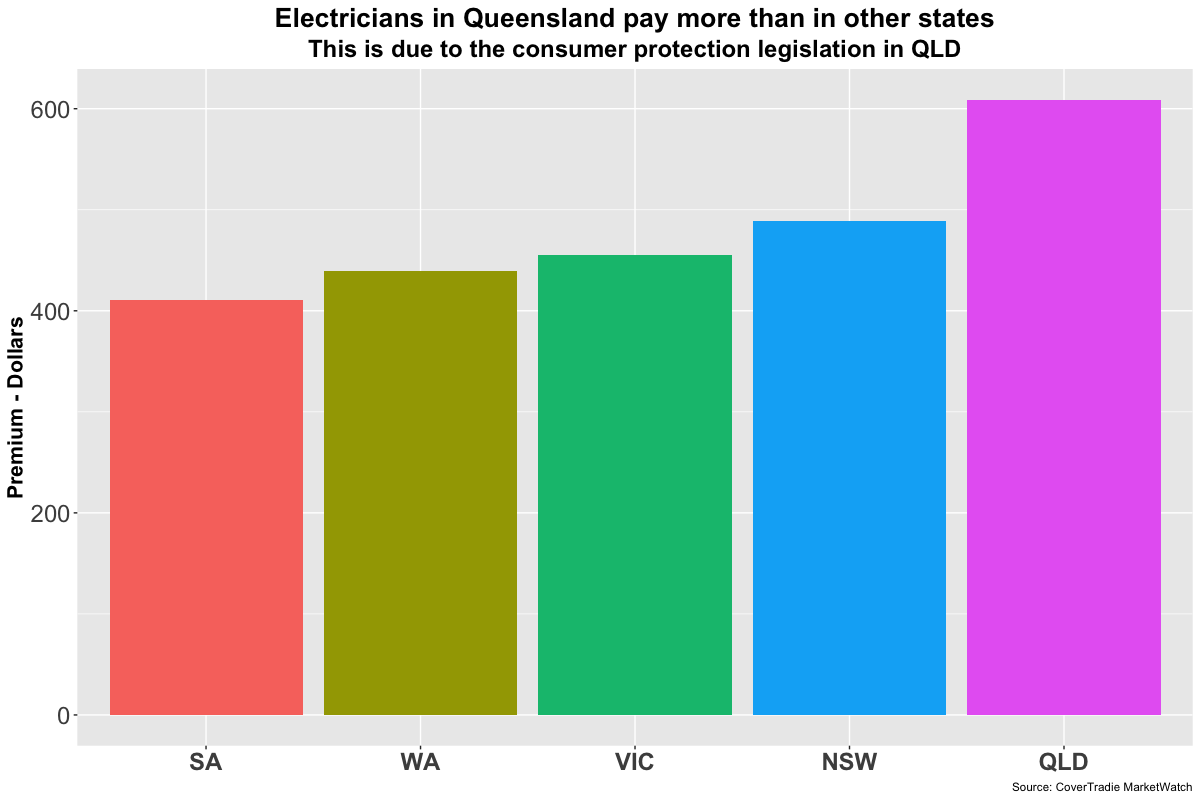

In the next chart below we show the lowest premiums we have seen for Electrical Contractors Insurance in different states.

Key Observations:

Electrician Contractor Insurance QLD cost is the highest due to the consumer protection legislation where as SA & WA pretty close to each other on the lower side.

NSW sparkies pay the most out of all the non-consumer legislation states. It seems like everything is expensive in Sydney.

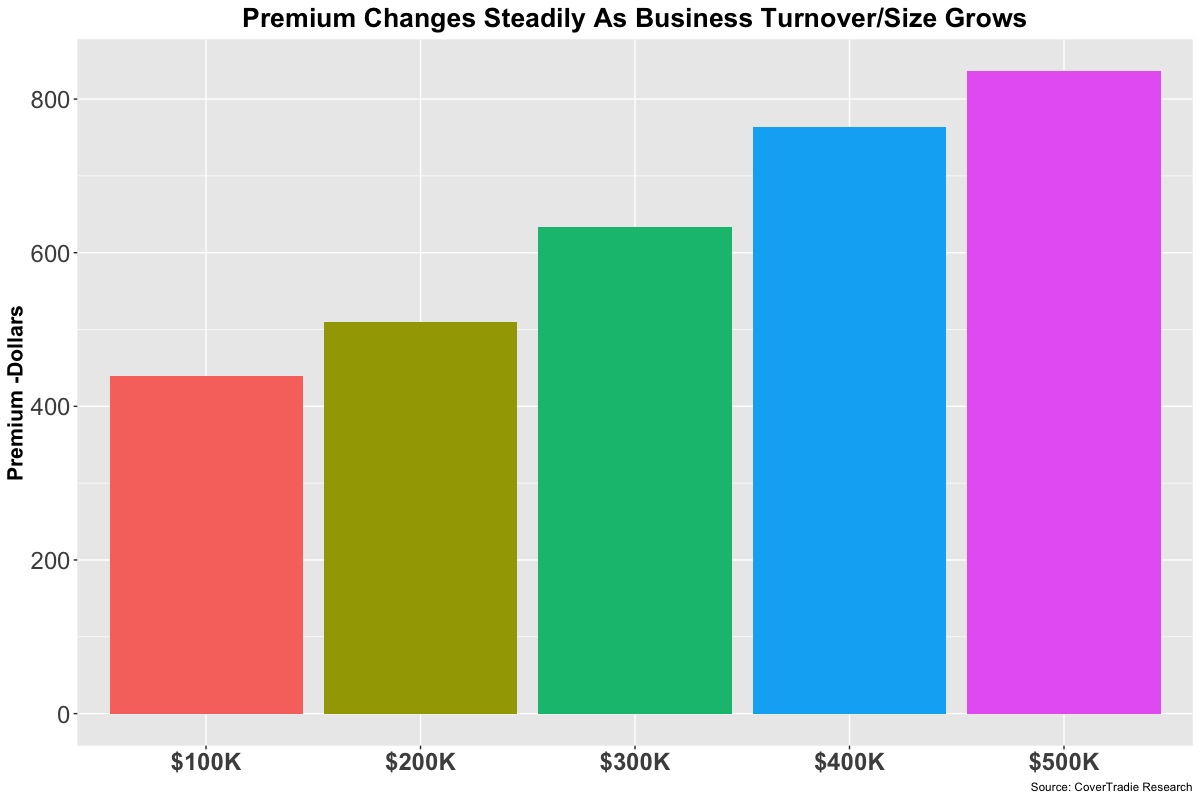

But not everyone is in the same boat as a start up electrician business with a turnover of $100,000. What happens as the turnover increases?

Will it change the premium? YES.

Common sense tells us that premiums will increase with the increase in turnover.

How much that increases really depends on the insurers. Some don’t see much difference between turnovers of $100K vs $200K but others do.

The general trend is upwards though with increase in turnover. Lets see:

Observe closely and you will notice that there is a small increase from 100k to 200k than there is from 200K to 300K.

This is because, insurers think that with turnovers of up to $200K, you are still quite a small business and likely only have 1 or 2 staff.

Less staff numbers means, more controls which translates into lesser events that lead to a claim. Beyond $200K, the number of claims rise and so do the premiums.

5 million vs 10 million vs 20 million limits

Like we said earlier, when you start, a limit of $5 million might be suitable as you are doing jobs to meet the needs of domestic clients.

Often many Tradies work with larger businesses as sub-contractors who generally dictate how much insurance you should have.

In which case you may need a $10 or $20 million limit, there by raising the question:

What is the cost of 10 million public liability insurance or cost of 20 million public liability insurance?

There is some increase in premium with higher liability limits but its not huge. See table below:

| Limit | Lowest | Average | Highest |

| $5 Million | $ 439 | $ 518 | $ 708 |

| $10 Million | $ 527 | $ 629 | $ 850 |

| $20 Million | $ 604 | $ 766 | $ 982 |

Want some more insights, have a look at this table below which give you combinations of the liability limit vs your business turnover.

| Turnover | $5 Million | $10 Million | $20 Million |

| $100K | $ 439 | $ 527 | $ 604 |

| $200K | $ 510 | $ 634 | $ 831 |

| $300K | $ 634 | $ 812 | $ 1,037 |

| $400K | $ 764 | $ 944 | $ 1,208 |

| $500K | $ 836 | $ 1,021 | $ 1,493 |

If you broker or insurer is charging more than these figures, there’s one thing you can do for them not looking after your best interest. Give us a call! We will sort out your insurance properly.

Insurance that saves money and prevents unnecessary claims headaches.

That was just a high level view of Electrician insurance in WA.

As you can see that there is a lot of pricing options available in the market. Its certainly a bad strategy to pay any more than what you need to. There are some insurers who see electricians as a high risk occupation and others who don’t.

A knowledgable broker can make a difference and we think we know a thing or two about the tradies insurance market so give us a call and we’d be more than happy to sort out insurance for you.

Insurance Types