Many have been lead to believe that Electrical Contractor Insurance in SA is expensive because Electricians are a high risk trade.

You know what,There’s NO NEED to believe this BS.

Keep in mind:

- Electrician insurance is cheaper in SA than any other state in Australia

- Good insurance starts around $411 for 12 months or around $38 per month

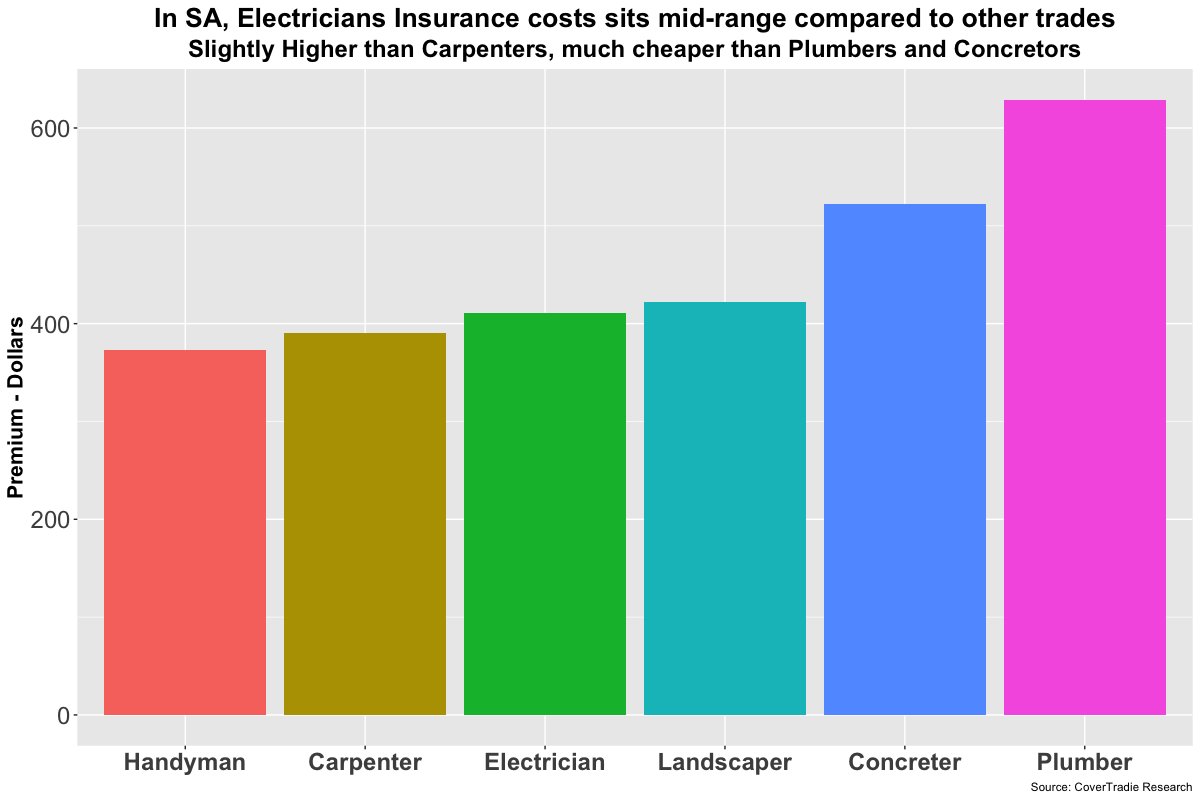

- Insurers consider Electricians almost similar risk to Carpenters, Landscapers etc.

- Get your insurance from a specialist broker not just any body.

CoverTradie’s knowledge has helped many and now you can benefit also. You just need the right insurance that saves money and prevents claim time headaches.

Getting insurance with CoverTradie is as easy as…1,2,3

Quick Phone Call

No Forms to Complete – We do that for you

Get Your Options

We do the heavy lifting of finding the right insurance for you

Pay And You Are Done

Monthly or Annual Payment Options

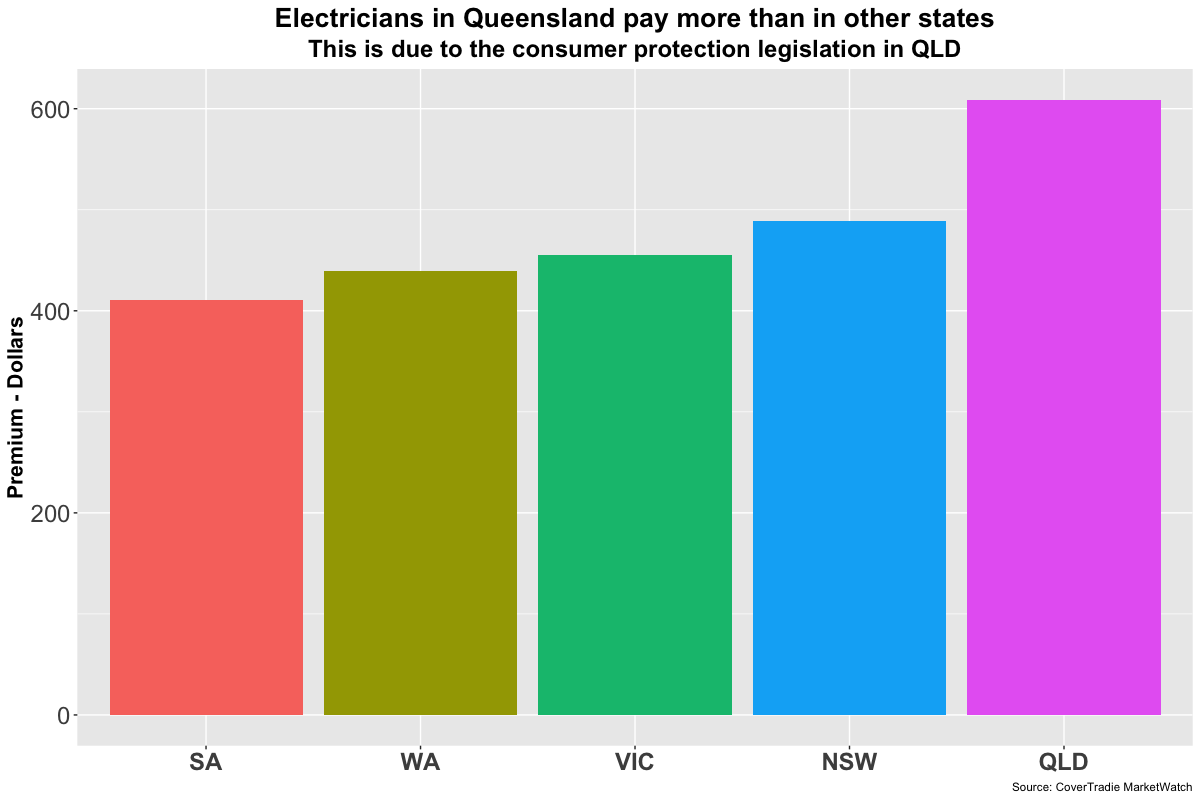

If there was one state you rather be in to get Electrical Contractor Insurance, then it has to be South Australia.

South Australia has lower prices for Electricians Insurance than any other state, well at least we have seen one higher and we do a fair few quotes.

See the chart below:

Key Observations:

Electrician Contractor Insurance QLD cost is the highest due to the consumer protection legislation where as SA & WA pretty close to each other on the lower side.

NSW Electricians pay the most out of all the non-consumer legislation states. Tough luck electrical contractors NSW

You may wonder, why is the price of insurance for electricians so low in South Australia?

The answer is simple, there are some simple reasons:

- Electricians are not required to have consumer protection insurance built into their public liability insurance unlike for Electricians in Queensland and Plumbers in Victoria.

- Many insurance classes in SA are cheaper in general compared to other states.

- Electricians in general are pretty careful, the frequency of claims against electricians are low. Having said that if there is a claim, it can be large.

All of this only means one thing, lower prices for Electricians Insurance in South Australia.

We will get the pricing conversation in a minute but there is often another question asked of us by Electricians.

What insurances do I need to be an electrician?

You can read about our detailed article here where we have gone into the details that talk about Electrical Contractors Insurance in general.

In this article, we have focussed on the Electrical Contractor Insurance Cost in SA.

Public Liability Insurance

Chances are that you would be allocated a job if your head contractor or your direct client has seen the certificate of your public liability insurance.

What is Public Liability Insurance?

If as part of your business activities you are found responsible for a damage caused to someone’s property or injury to a person or even their death, you want to make sure you have the right insurance – Public Liability Insurance.

For electricians it could mean:

Replacing a broken switch at someone’s property, you didn’t insulate the live wires properly. With the heat of the current, eventually the wires fused causing a short circuit burning the house down.

An event like this can generate a large claim if you are held responsible for the property damage. The right public liability insurance is absolutely necessary in an event like this.

This is a must have insurance, regulators in each state make it mandatory that you have at least $5 Million dollar coverage which really only startup guys take up.

Whether you need $5 Million, $10 Million or $20 Million coverage, will most likely depend on the type of jobs you do and who you work with.

As a subcontractor to other business particularly large business, you will be asked to provide a certificate of currency of $20 million coverage.

What is the cost of Electrical Contractors Insurance in SA?

The cost of Electrical Contractors Insurance in WA starts at $411 for the year or about $38 per month. That is for a small business with turnover of $100,000 on a $5 Million liability limit.

Things that make a difference to your insurance premiums:

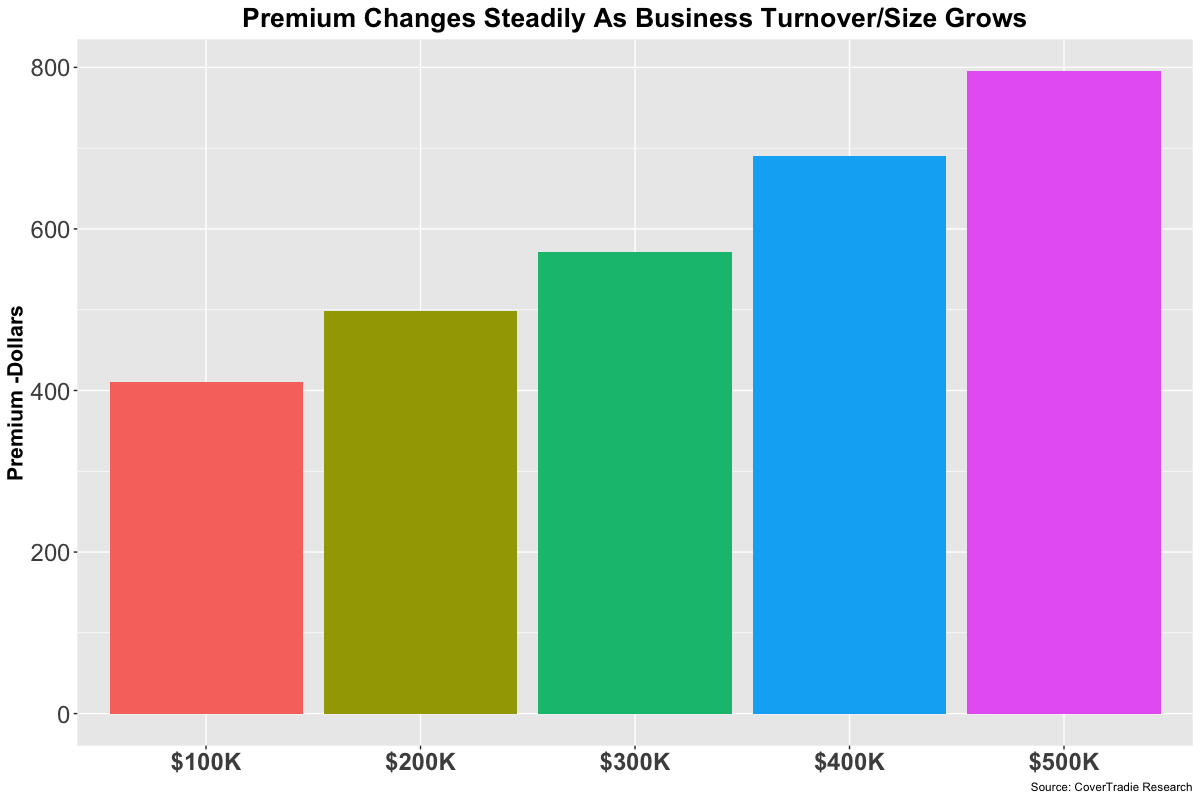

- Your business turnover, is it $100,000 or $500,000 or somewhere in between or more?

- Location/State – we know SA has some pretty low rates.

- Occupational Activities – What jobs are you picking up, domestic, commercial or industrial?

- Do you have any claims history?

- Level of cover etc. – $5Million coverage or $50 Million?

As you can see, there are many little things which change the risk in you business which causes insurers to change the premiums. All tailored to your individual circumstances.

Let’s explore further:

Not only that, the insurance for Electrical Contractors in SA is cheap compared to your electrician colleagues in other states, that you know from the chart we presented earlier.

Would it be nice if everyone could get their insurance for $411?

Unfortunately, not everyone is in the same boat, variations in your business result in difference in premiums.

So if you asked, is there a change the premium if your turnover is higher?

YES, there is!

Common sense tells us that premiums will increase with the increase in turnover.

How much that increases really depends on the insurers. Some don’t see much difference between turnovers of $100K vs $200K but others do.

The general trend is upwards though with increase in turnover. Lets see:

Observe closely and you will notice that there is a jump increase from 100k to 200k than there is a small change from 200K to 300K.

5 million vs 10 million vs 20 million limits

Like we said earlier, when you start, a limit of $5 million might be suitable as you are doing jobs to meet the needs of domestic clients.

Often many Tradies work with larger businesses as sub-contractors who generally dictate how much insurance you should have.

In which case you may need a $10 or $20 million limit, there by raising the question:

What is the cost of 10 million public liability insurance or cost of 20 million public liability insurance?

There is some increase in premium with higher liability limits but its not huge. See table below:

| Limit | Lowest | Average | Highest |

| $5 Million | $ 411 | $ 516 | $ 715 |

| $10 Million | $ 514 | $ 627 | $ 858 |

| $20 Million | $ 528 | $ 761 | $ 991 |

If you broker or insurer is charging more than these figures, there’s one thing you can do for them not looking after your best interest. Give us a call! We will sort out your insurance properly.

Insurance that saves money and prevents unnecessary claims headaches.

That was just a high level view of Electrician insurance in SA.

As you can see that there is a lot of pricing options available in the market. Its certainly a bad strategy to pay any more than what you need to. There are some insurers who see electricians as a high risk occupation and others who don’t.

A knowledgable broker can make a difference and we think we know a thing or two about the tradies insurance market so give us a call and we’d be more than happy to sort out insurance for you.

Insurance Types