Many concreters are either under-insured or spending too much on their insurance.

CoverTradie sets-up your insurance properly so that you have the right cover without spending a dollar more than you should.

Getting insurance with CoverTradie is as easy as…1,2,3

Quick Phone Call

No Forms to Complete – We do that for you

Get Your Options

We do the heavy lifting of finding the right insurance for you

Pay And You Are Done

Monthly or Annual Payment Options

The knowledge of a few little things will help you make better decisions when you get your Public Liability Insurance for Concreters.

In simple terms, this knowledge centres around:

- Policy Coverage & Exclusions

- Price or Cost Estimate

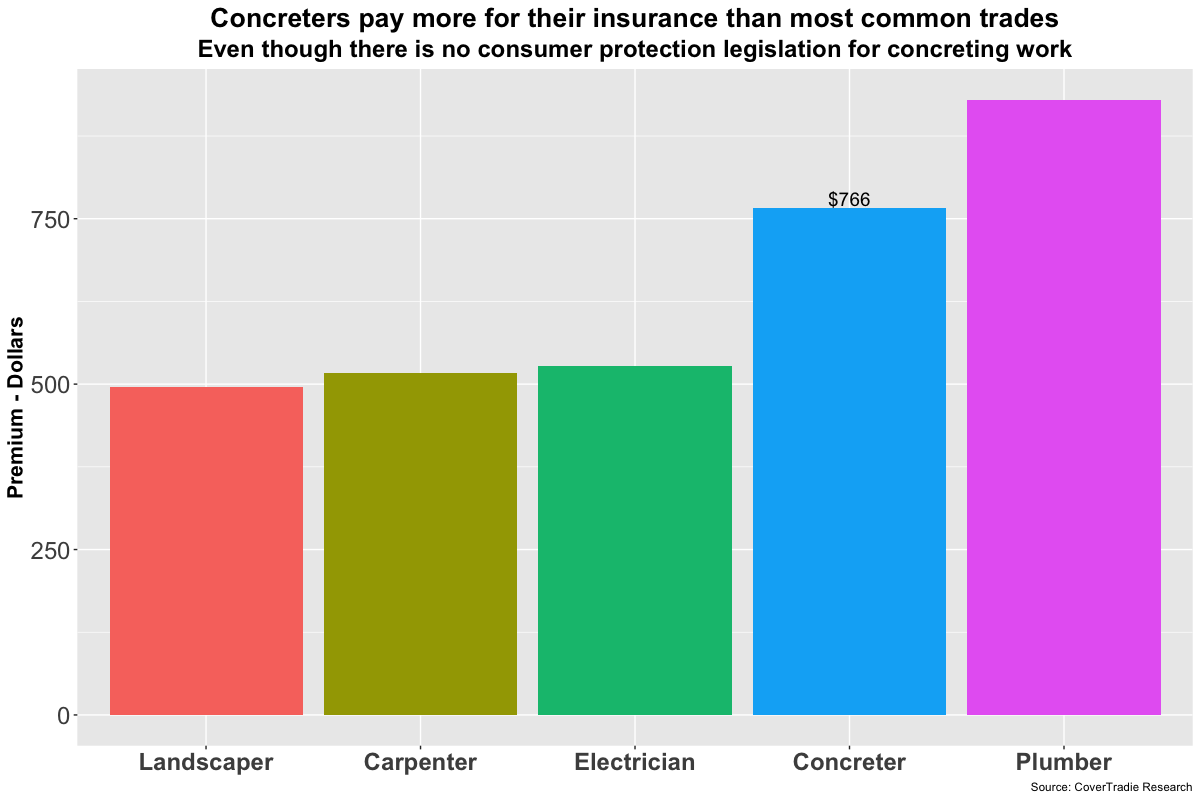

Public Liability Insurance for Concreters is expensive. Not the most expensive but its on the high side if we were to compare some common trades.

Notice from the chart below, the cheapest premium for concreters is about 50% more than the cheapest for landscapers, carpenters and electricians. Plumbers pay more than concreters due to higher claim volumes.

The reason behind the higher premiums for concreters are the higher volume of claims. Insurers see this risk from two angles, the occupation itself has a higher risk in spite of how careful the workers are and then the other part is due to the so called “cowboys” in the industry.

The do all sorts of things which drive up claims volumes which subsequently results in the insurance premiums going up because insurers have to collect enough premium by law to be able to pay out the claims and then make a margin on top to run their business.

How much does Public Liability Insurance for Concreters Cost?

There are a large number of prices available in the market. Most insurers see Concreters as a high risk occupation compared to some other trades. This results in higher average cost for Public Liability Insurance for Concreters. The table below displays that variation in the cheapest, average and highest prices we observed. See below:

| Category | Cost |

| Cheapest | $766 |

| Average | $1054 |

| Highest | $1687 |

The above prices are for someone who has a small business, obviously they go up as your business turnover increases however it highlights the importance of being with the right insurers who treats your risk lower and offers a lower premium.

Knowing which insurers price concreting contractors business favourably is very important.

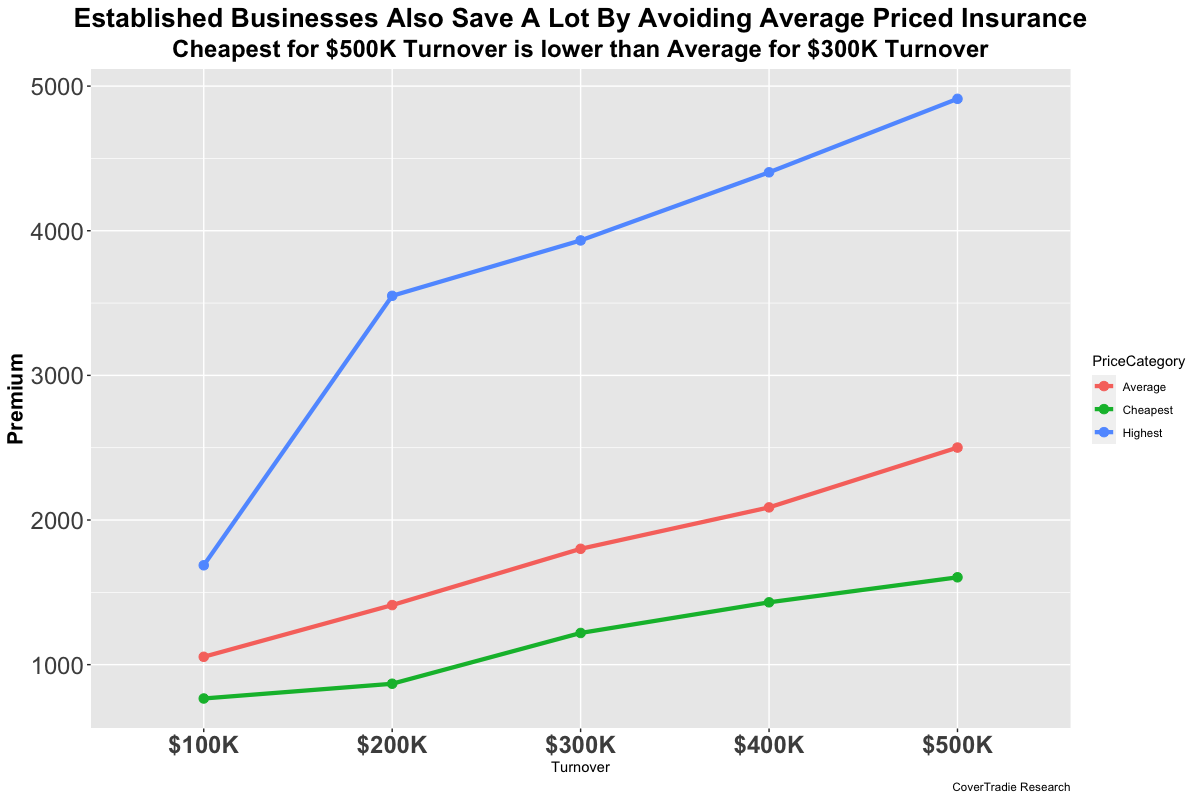

Imagine how much more would you pay extra over the years if your broker was not able to find the cheapest price but only something that was close average premium. You’d be paying a LOT! Let’s explore further.

So which states enjoy the cheapest premiums for Concreting Contractors Insurance?

Prices vary a bit between different states. Whilst we found that the cheapest policy for a small concreting business was in WA. On average, the cheapest premiums being offered were in SA.

See our table below for cheapest, average and highest premiums for Public Liability Insurance for Concreters in Australia.

| State | Cheapest | Average | Highest |

| WA | $766 | $1,001 | $1,484 |

| SA | $779 | $951 | $1,498 |

| VIC | $792 | $1,067 | $1,543 |

| QLD | $849 | $1,019 | $1,471 |

| NSW | $852 | $1,233 | $1,687 |

NSW take the honours for most expensive insurance for concreters.

The most important thing to note is the difference between the Highest and Cheapest premiums.

Signing up with the wrong insurer can cost a lot more, look its not going to be the end of the world if you end up paying $500 more than you should, but ideally that money should stay in your pocket and be used up wisely rather than giving away to a large insurer.

With knowledge, its easy to save $200-$300 dollars from average to cheapest for small business but even bigger business can save which we explore further.

Insurance Types

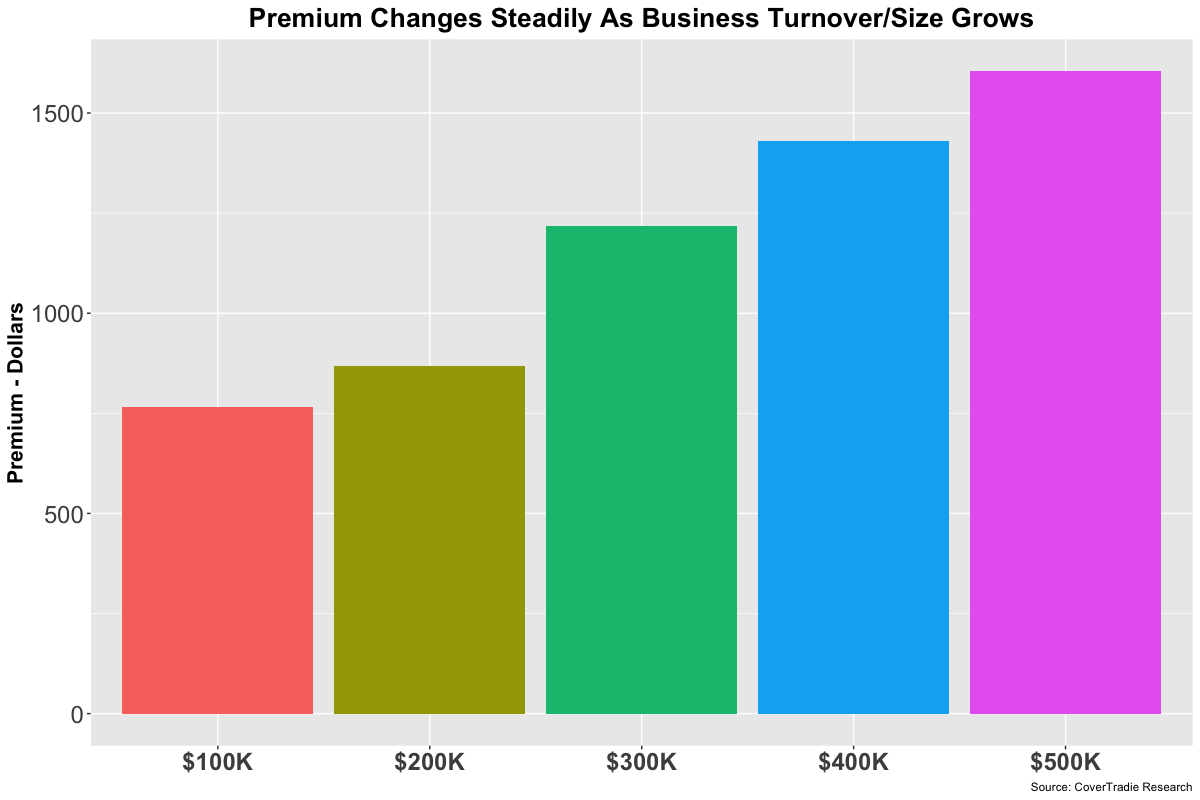

What happens to the price of insurance as your business grows?

Regardless of what state you work in, as the business grows, the risk of claims also increases. Insurers know that and hence they increase the premiums as your business grows. See chart below:

Insurers consider that insurance risk increases as a business grows?

During the growth phase of a business, the attention of many tradies gets a little stretched. Not everyones’ but some. That can result in claims and insurers know that. They price the insurance accordingly.

For many business owners, it’s the apprentice supervision that is a problem. Its not uncommon to see the claims increase with increased number of staff and junior apprentices

The controls & risk management in a business that prevent claims and stuff-ups become strong over time. There is a period when they are weak which result in claims.

You can’t control what insurers think and how they price insurance. You can make a choice of insurer and your broker. That will save you money.

The importance of the above statement is further demonstrated by this chart below. It highlights that the cheapest polices save a lot of money in the long term.

Notice how the premium of Cheapest Price Category at $400K turnover is the same as $200K turnover for the Average Price Category(redline).

In all, select a broker who knows what they are doing so they can help you get where you want to – FASTER.

CoverTradie is a specialist insurance broker for tradesmen. If we can be of help to you, please give us a call. If you found this article useful, please consider sharing it on Facebook to help us get the word out.

Insurance Types

Exclusions – Be very careful about these.

You can be guaranteed that every insurance policy has some exclusions. There are those which you can avoid and then those that are insurer specific.

You want to make sure your policy has the least amount of exclusions particularly if they affect the coverage for something that you are trying to do. As an example:

Restricted Industries Exclusion: Many insurers clearly state that their policy doesn’t cover for your work if you are a contractor working in some high risk industries like Aviation, Railways, Defence, Oil & Gas etc. In this case, if you have won a contract to do some work which falls in the category of restricted industries for your insurer, you need to be careful.

Other exclusions that are commonly there on Concreters Insurance are:

- Excavation Depth greater than 3.5 metres

- Silica dust related claims

- Rip & Tear Exclusion

- Underground services damage

- Hazardous waste discharge

We can’t stress enough on how important it is to know your exclusion because it can leave your policy worthless even though you have spent a bit of money. Give us a call to discuss more.

Which insurer offers the best Public Liability Insurance for Concreters?

This one is a very subjective question. Is it best in terms of price, coverage or claims service. Where there is no variation in the policy coverage, obviously the lower the price the better it is for the customer.

CoverTradie always finds you the cheapest deal unless there is serious service issues from the insurer perspective that we may have experienced.

Every broker will have a different experience with different insurers that why you often hear them say “This insurer pays the claims.” It is important to note though that all insurers have to abide by the rules set by AFCA for any disputes that arise, which means that if there is a dispute and the policy wording has to cover a claim, insurers can’t get away with it. As you broker, we act as the go between anyway. We keep them honest. That’s our job.

Can I pay my policy by the month?

Yes, with CoverTradie you can pay by the month. Give us a call.