Many Tradies end up paying too much for their insurance because of one or more of the following reasons:

- Their broker didn’t know which insurer was offering the best price for their insurance

- They took advice from a mate who recommended somebody they knew

- Their bookkeeper put them on to their “insurance broking mate”

- Believed the story that all trades are a high risk and accepted high premiums are okay

- Got advice from a generalist and not a specialist in trades.

CoverTradie’s research will help you understand the Public Liability Insurance Cost in QLD for Tradies so that you can make an informed purchase.

So what does Public Liability Insurance Cost in QLD?

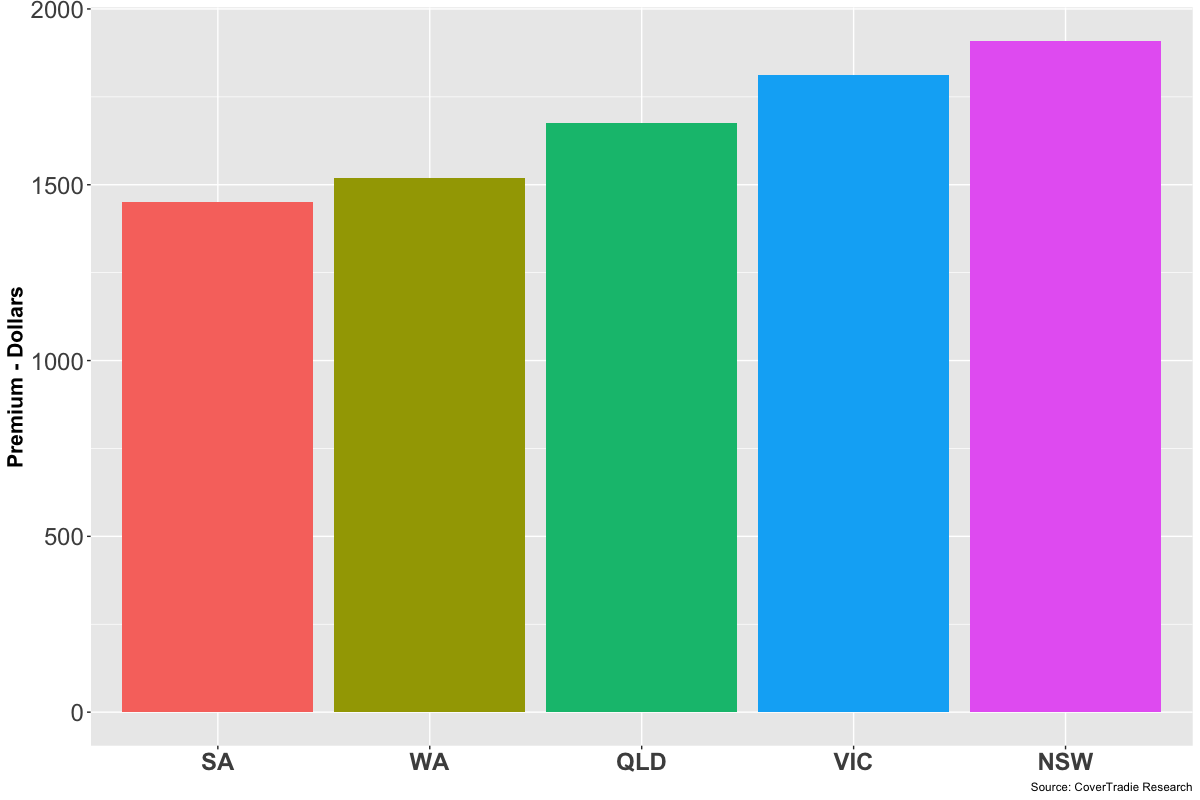

The average cost of public liability insurance in Queensland sits right in the middle when compared to other states. See chart below:

The word Average reflects the public liability insurance cost in Queensland very well.

But average is an average, it may not mean anything to you. Averages incorporate everyone and we know we are generally quite different to everyone else.

These difference relate to our occupations, the size of our businesses, the nature of activities performed, our claims histories and regulatory influences.

You may also want to know what the cheapest and the dearest premiums that we came across. The table below shows the cheapest, average and the highest cost of Public Liability Insurance in QLD for Tradies.

| Category | Price |

| Cheapest | $517 |

| Average | $1676 |

| Highest | $6230 |

It’s easy to see that there is a huge variation between the cheapest, average and the highest premiums we have observed.

So what drives such a huge variation in the pricing?

There are a few factors some more specific to particular insurers but most commonly:

- Is there any consumer protection legislation for your trade that results in higher claim volumes, which increases insurance costs

- Your occupation risk – not all trades carry equal risk

- Business activities within your occupation – not all business activities carry equal risk

- Size of your business – higher turnover and staff count usually means higher risk of claims

- The market factors in a particular state, competition etc.

Public Liability Insurance cost comparison by trade

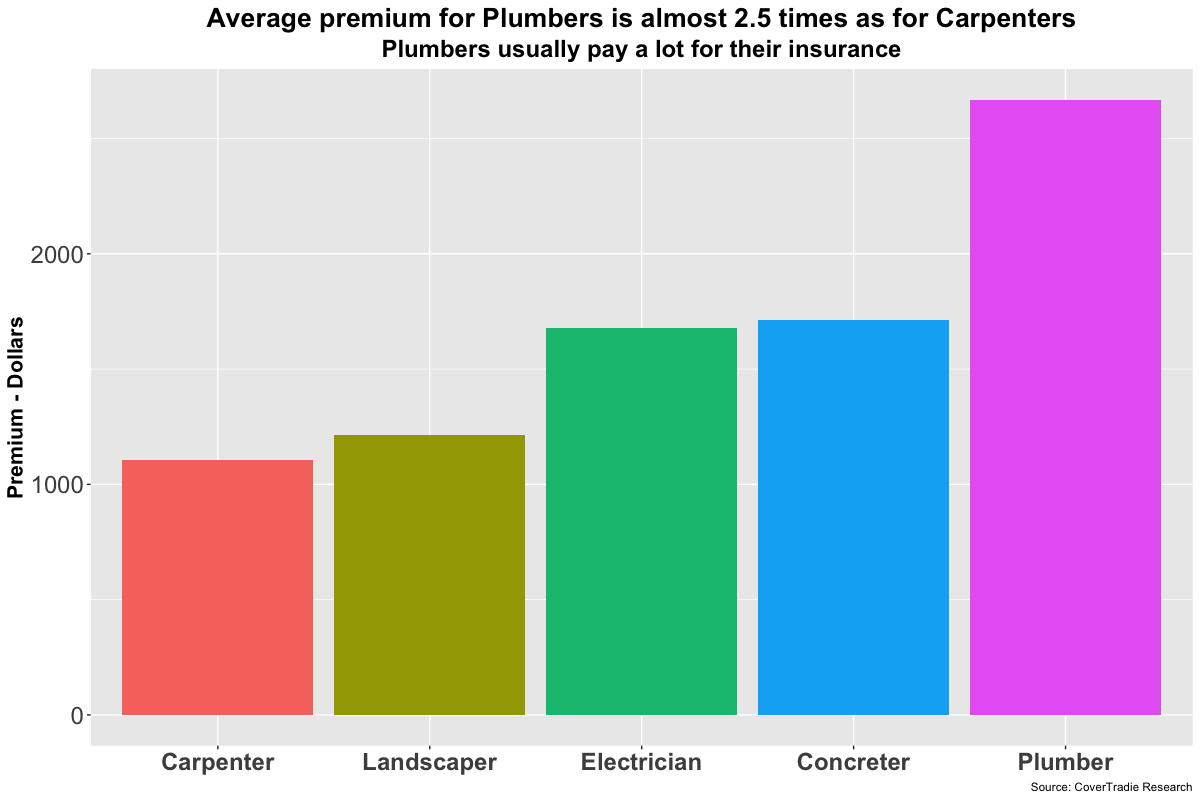

Your occupation has a very big influence on the pricing of public liability insurance. In fact it is the most important risk factor as insurers would call it.

Insurers often say outright “No” to insuring certain occupations that don’t fit in their risk profile. An example: try getting insurance for Elevator Repairs Trade or High Rise Window Cleaning Work. There are only a handful of insurers who are interested to cover you.

The chart shows a comparison of average premiums we observed for 5 common tradie occupations.

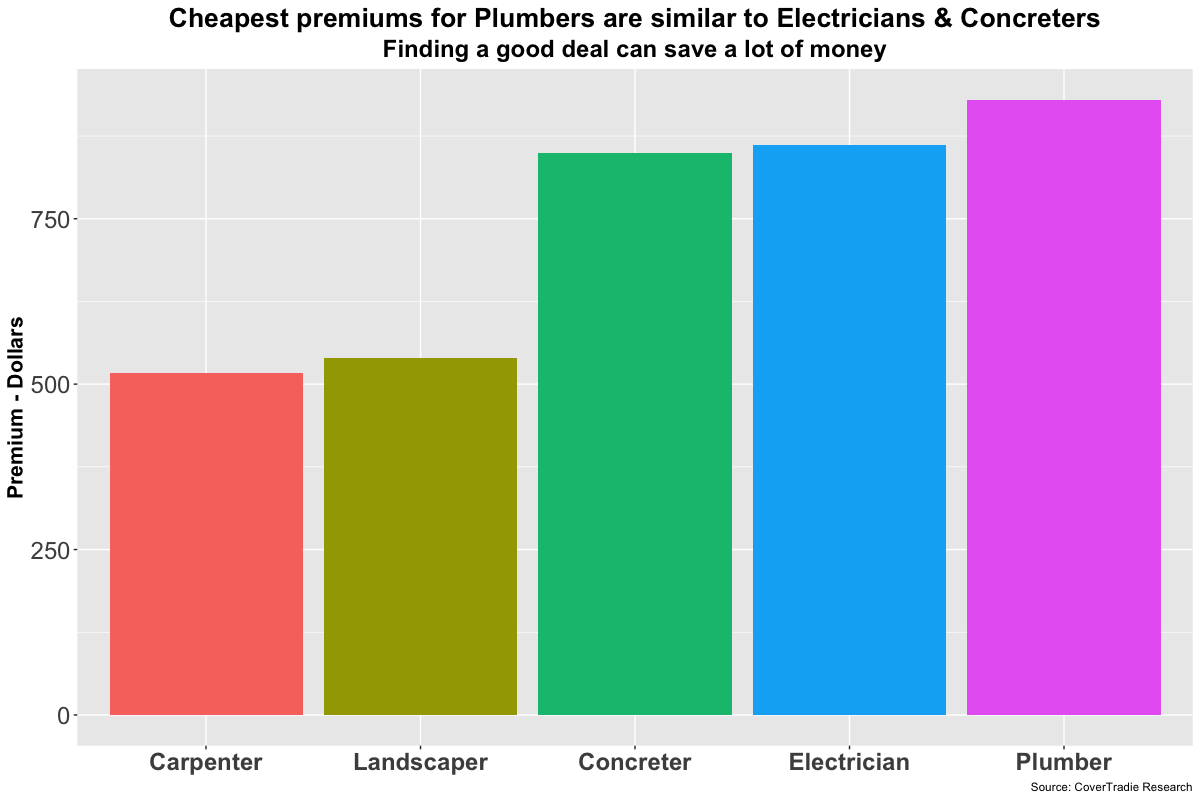

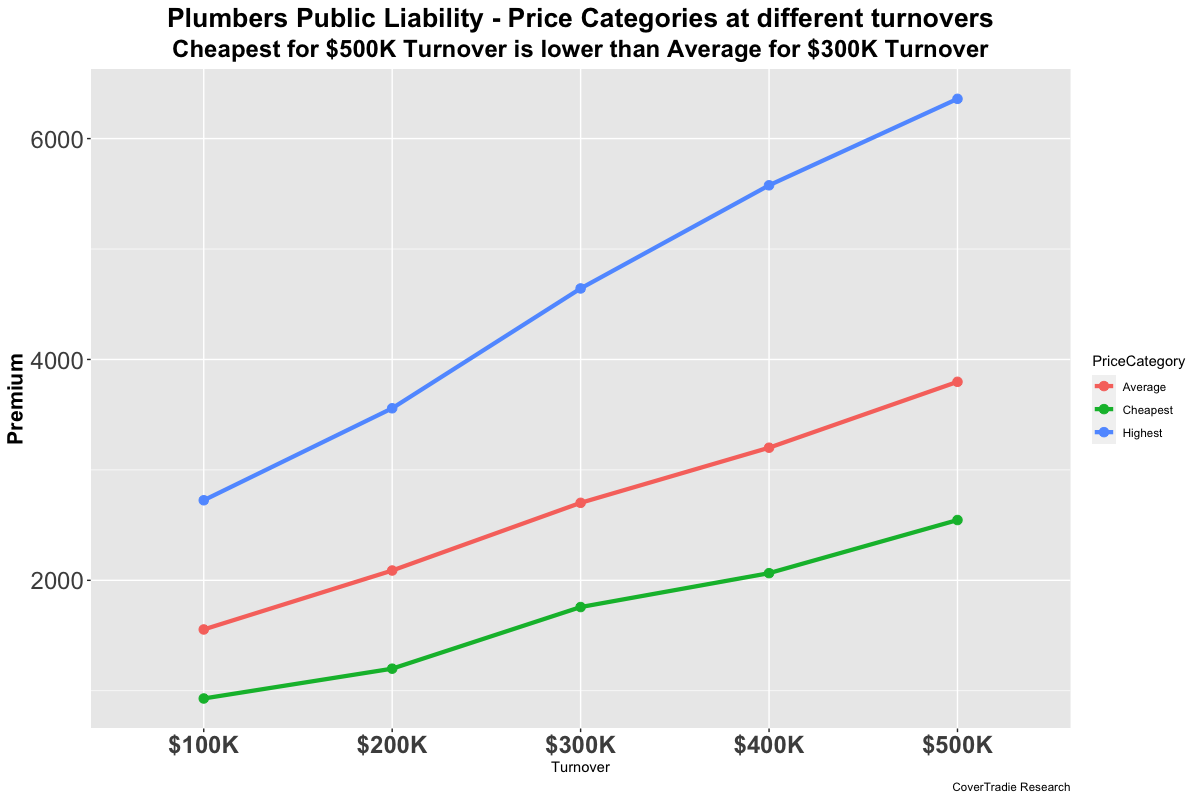

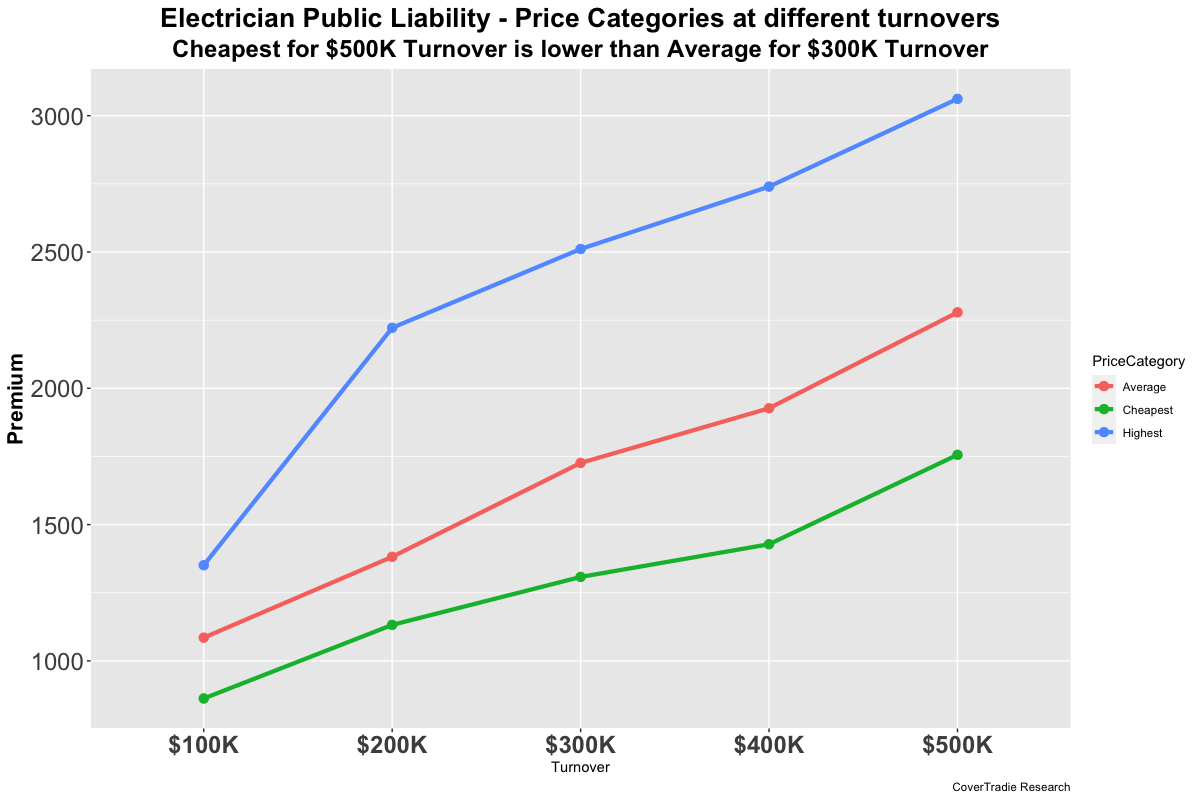

As above, on average Plumbers pay a lot more than other trades but with a bit of knowledge one can find good deals. The cheapest for Plumbers is only slightly higher than Electricians and Concreters. See chart below:

The prices are for $20million public liability quotes we observed for businesses ranging from $100k to $500K in turnover.

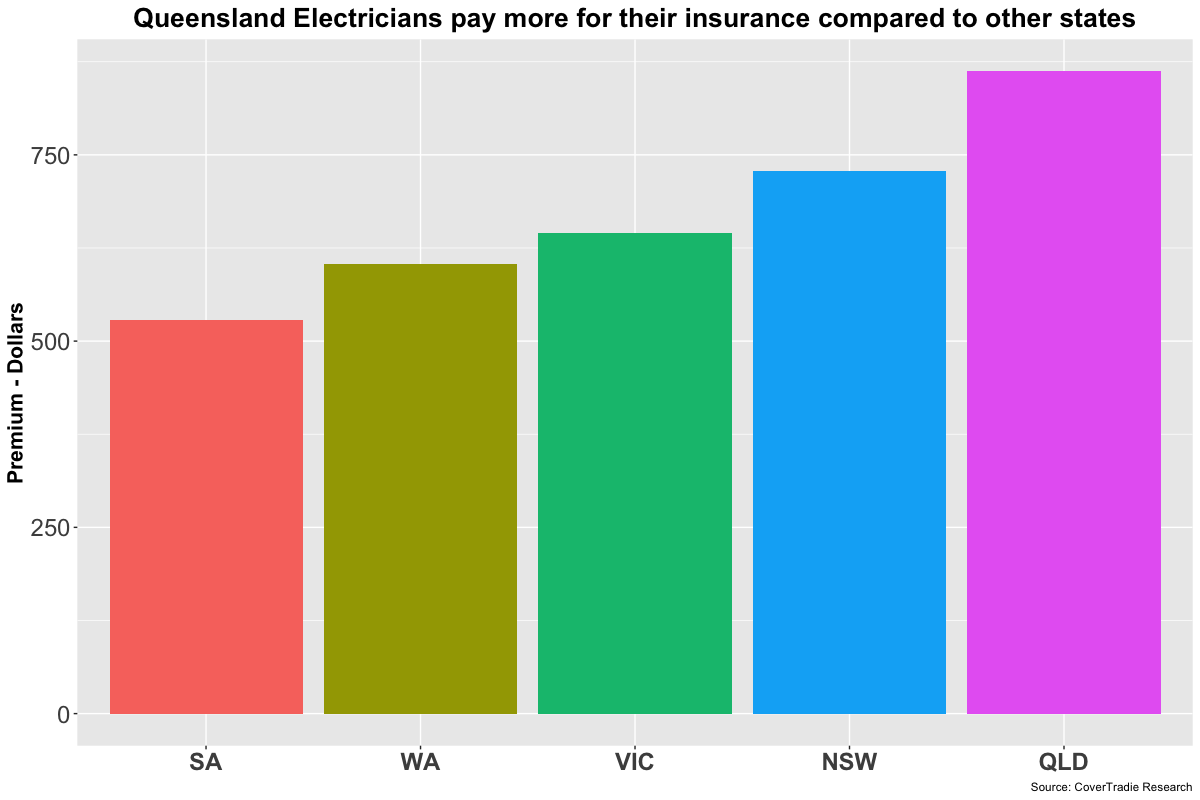

Electricians in QLD also pay more for their insurance than anywhere else in Australia. See chart below which compares the average cost of insurance for Electricians across states in Australia.

The table below goes into a bit more detail of prices as we include other occupations too. Check the cheapest, average and highest prices for public liability insurance in Qld for 5 common trades.

| Occupation | Cheapest | Average | Highest |

| Carpenter | $517 | $1,104 | $1,759 |

| Landscaper | $539 | $1,216 | $2,272 |

| Concreter | $849 | $1,715 | $2,961 |

| Electrician | $862 | $1,680 | $3,062 |

| Plumber | $930 | $2,669 | $6,360 |

So why is there such a price variation even with in occupation groups?

The biggest reason is the turnover of your business, those with turnover of $100,000 are cheaper to insure compared to the one with a $500,000 turnover.

Insurers consider that risk increases as a business grows.

During the growth phase of a business, the attention of many tradies gets a little stretched. Not everyones’ but some. That can result in claims and insurers know that. They price the insurance accordingly.

For many business owners, it’s the apprentice supervision that is a problem. Its not uncommon to see the claims increase with increased number of staff and junior apprentices

The controls & risk management in a business that prevent claims and stuff-ups become strong over time. There is a period when they are weak which result in claims.

You can see the impact of turnover on pricing from the table below.

| Turnover | Cheapest | Average | Highest |

| $100K | $517 | $1,023 | $2,725 |

| $200K | $609 | $1,327 | $3,558 |

| $300K | $735 | $1,700 | $4,643 |

| $400K | $1,013 | $1,975 | $5,577 |

| $500K | $1,114 | $2,359 | $6,360 |

Key points to note from this table are:

- Lower turnover means lower risk in general

- Notice all categories of prices i.e. cheapest, average and highest, they all increase with increase in turnover.

There are opportunities to save money regardless of what your turnover may be, an example of that is give below. In this chart we show how the various premium categories for Plumbers & Electricians in QLD.

You can’t control what insurers think and how they price insurance. You can make a choice of insurer and your broker. That will save you money.

So, select a broker who knows what they are doing so they can help you get where you want to – FASTER.

CoverTradie is a specialist insurance broker for tradesmen. If we can be of help to you, please give us a call. If you found this article useful, please consider sharing it on Facebook to help us get the word out.

Insurance Types