Electrical contractors insurance qld

Electrical Contractors Insurance QLD Done Properly & Promptly

Whether its your first time getting the Electrician Insurance or you are looking for a better renewal, we can help you!

Avoid

- Insurance doubts

- Getting ripped-off

- Unpaid claims

Get

- Clarity of cover

- Sharp pricing

- Managed Claims

With CoverTradie you get

Solid Insurance Cover

Get peace of mind that you & your family are well covered

Affordable Pricing

Save money for the new ute, boat or for financial investments

Great Service

Professional insurance work, done quick and explained in plain English

Just like ordering an Uber, it’s as Easy as…

Quick Phone Call

No Forms to Complete – We do that for you.

Get Your Options

We do the heavy lifting of finding the right insurance for you.

Pay And You Are Done

Monthly or Annual Payment Options

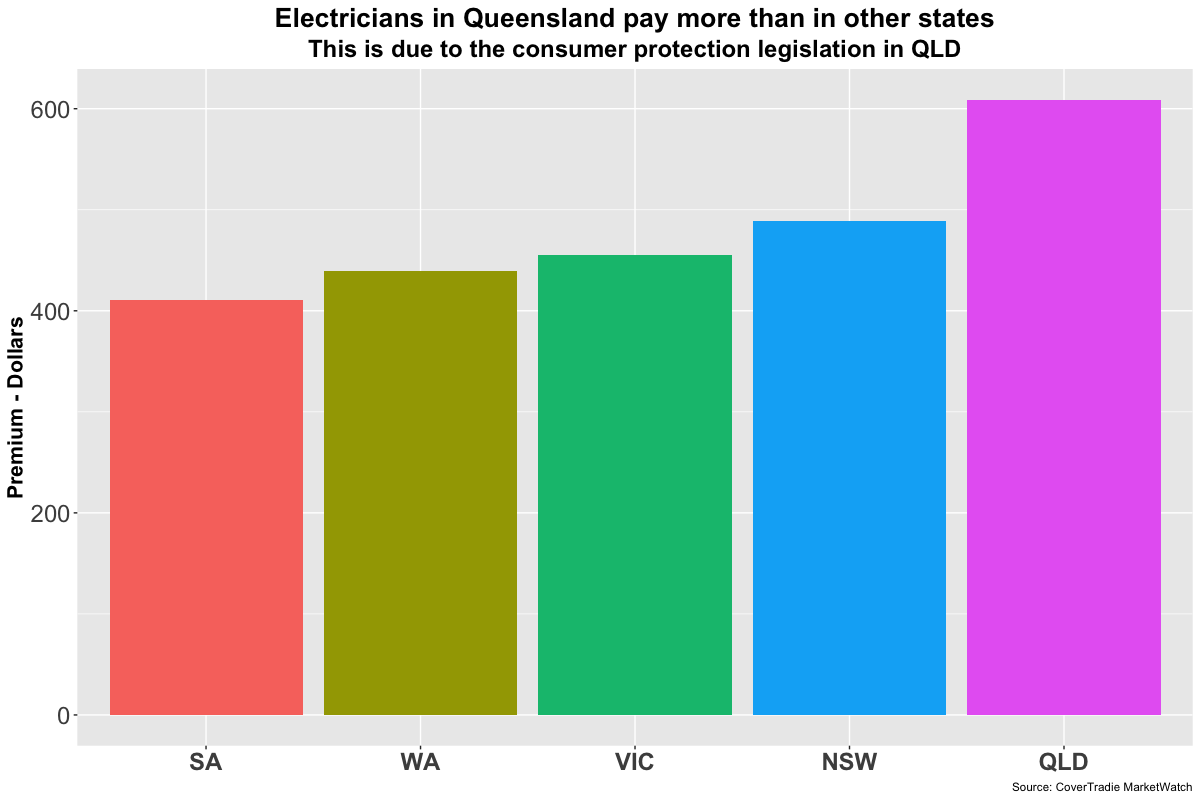

Electrician Insurance in QLD is expensive in general, more so than other states.

Who’s to blame?

Consumer Protection Legislation in QLD results in higher premiums!

Keep in mind though:

- Prices start around $609 for 12 months or around $56 per month.

- Plenty of insurers to chose from, so pick an insurer that pay claims. (We can help)

- Employ a specialist broker that has a deep understanding of Electrical Contractors Insurance Cost in QLD.

CoverTradie’s specialist broker for Tradies, we keep an eye out for what’s happening in the insurance market for our clients.

We’ll get you the right insurance that saves money and prevents claim time headaches. Easy As!

Electricians in Queensland ask two questions:

- What insurances do I need to be a compliant electrician in QLD?

- How much does Electrical Contractors Insurance in QLD cost?

You can read about our detailed article here where we have gone into the details that talk about Electrical Contractors Insurance that you need to not only be compliant but also be well protected.

There are many people who just want to get the bare minimum insurance and take on unnecessary risks.

That in our view point defeats the whole idea of insurance.

No point trying to become rich by cutting corners. You become rich by earning money not by not spending money on important things.

Having said that, it’s also no use lining up the pockets of large insurers. It’s all about finding that “sweet spot” where you get the biggest bang for your buck.

In this article, we have focussed just on that. Helping you know what is the price point of insurance you should be happy with.

Public Liability Insurance

In Queensland, the legislation requires that you maintain a minimum of $5 million public liability insurance cover which should also include $50,000 consumer protection cover.

Its an easy thing for us to do – pretty much a flick of button and we do it as part of the quote conversation as soon as we realise you are a Queensland based electrical contractor.

What is Public Liability Insurance?

Public Liability Insurance offers protection your business against a financial loss if, due to your work activities, you end up damaging someone else’s property or causing an injury to someone.

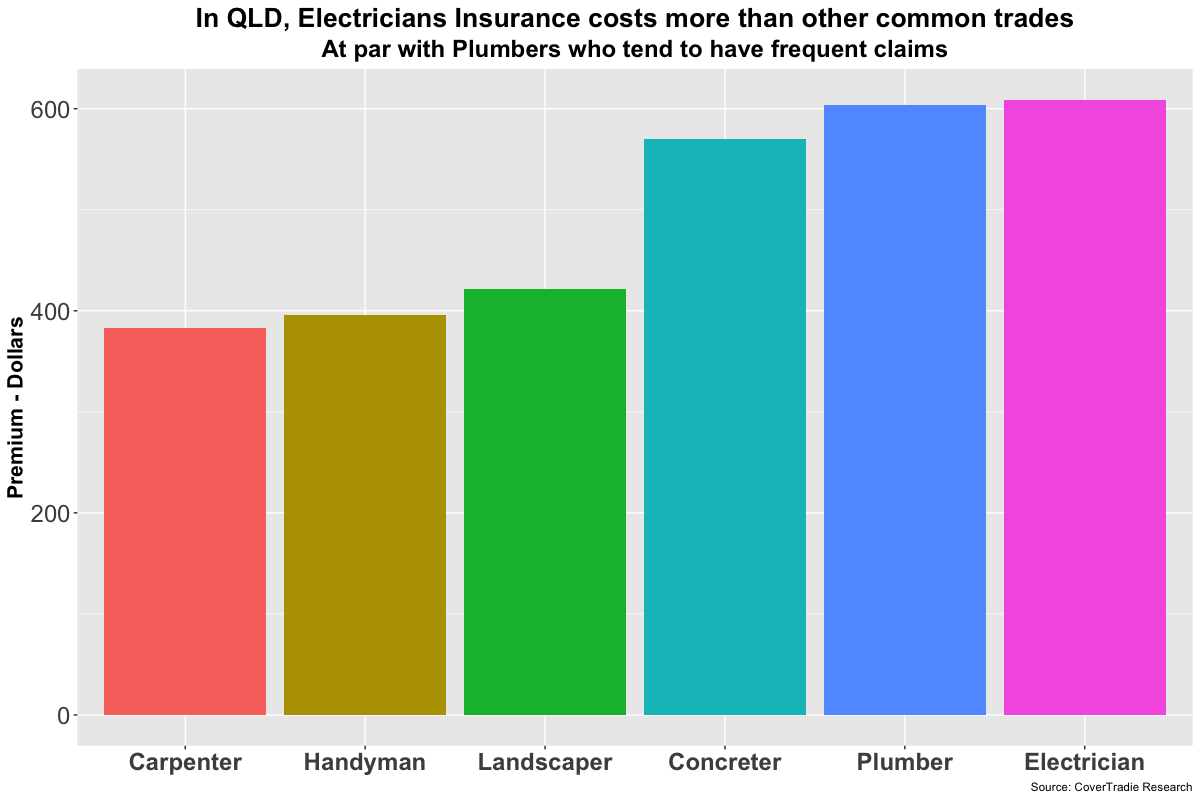

Whilst the claims against electricians aren’t that frequent compared to plumbers for instance, when they do happen, they are usually large.

For example:

Fires started due to poor electrical works can result in large damages and even loss of life. Often on TV news, you hear about houses or factories burning down due to electrical faults.

Insurers who insure those buildings want to identify who can they recover their losses from and usually the electricians who have done work on those properties are on top of the list.

So have good business practices and a good public liability insurer who you know is going to be there when the chips are down.

How much does Electrical Contractors Insurance QLD Cost?

Electrical Contractors Insurance in QLD costs start from $609 for the year or $56 per month. That’s for a small business with a turnover of $100,000 and a 5 million liability limit.

But everyone has unique circumstances, your premiums could be totally different to what others get and there are a few factors, like:

- Activities that you undertake, do you do bulk of your work on domestic projects, air-conditioning, renovations, decorative lighting projects etc. or more commercial jobs, infrastructure jobs like works on railway signals, tunnels etc.

- Business size – how much is your turnover, staff numbers etc.

- Subcontractors and Labour hire arrangements.

- Location/State

- Any significant Claims in the past that may be of interest to underwriters

- Level of cover required. $5 million, $10 million, $15 million or more…

On that note, let’s get some idea on insurance pricing in Queensland.

Queensland is the only state where Electricians pay more than Plumbers and Concreters for their insurance.

In the next chart below we show the cheapest premiums we have seen for Electrical Contractors Insurance in different states.

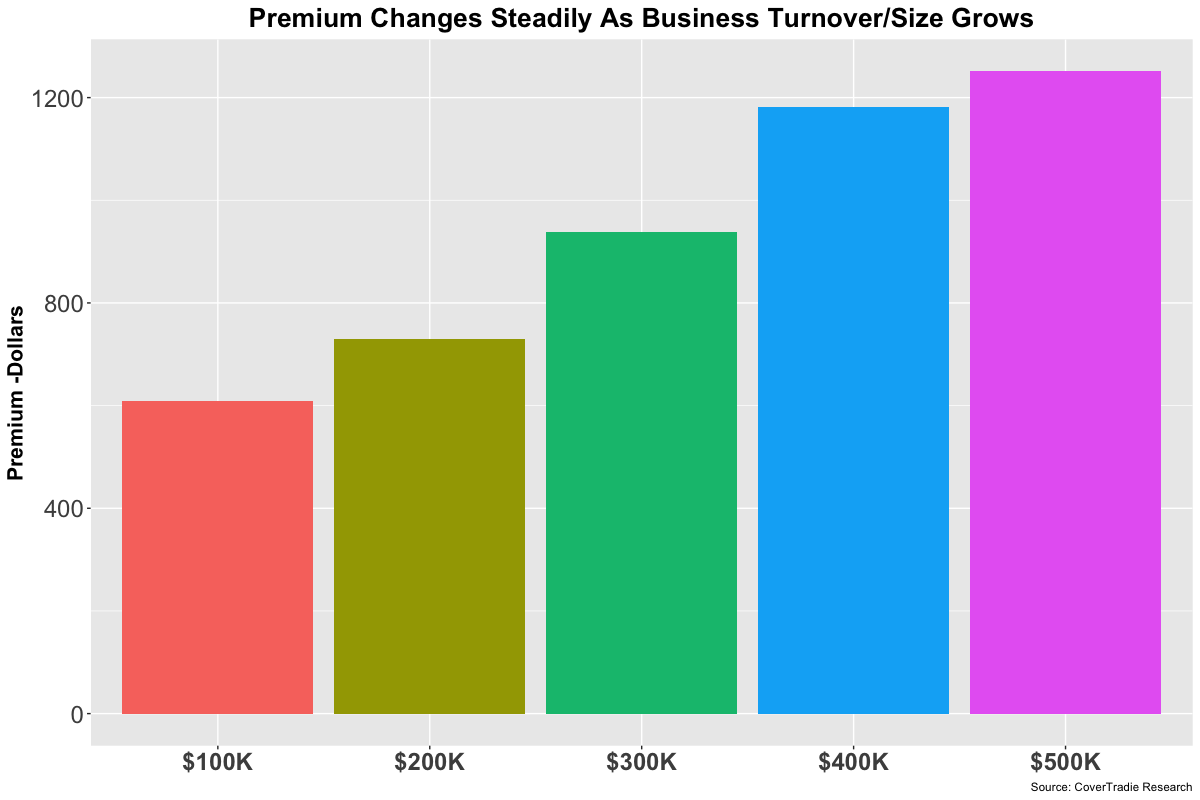

It might be well and good that your insurance is a small number of $609 but as your business grows, your turnover and staff size increases.

They have an impact on the risk in your business which means the premiums will go up generally with increase in premium.

It usually is only a small increase from turnover of $100K to $200K but then the changes are bigger.

This is because, insurers think that with turnovers of up to $200K, you are still quite a small business and likely only have 1 or 2 staff.

Less staff numbers means, more controls which translates into lesser events that lead to a claim. Beyond $200K, the number of claims rise and so does the premiums until you get to around the $500K turnover.

Insurers see that once a business has reached a critical mass, they can then invest in greater resources to control the quality of work. Notice how little the premium changes from $400K turnover to $500K.

See chart below:

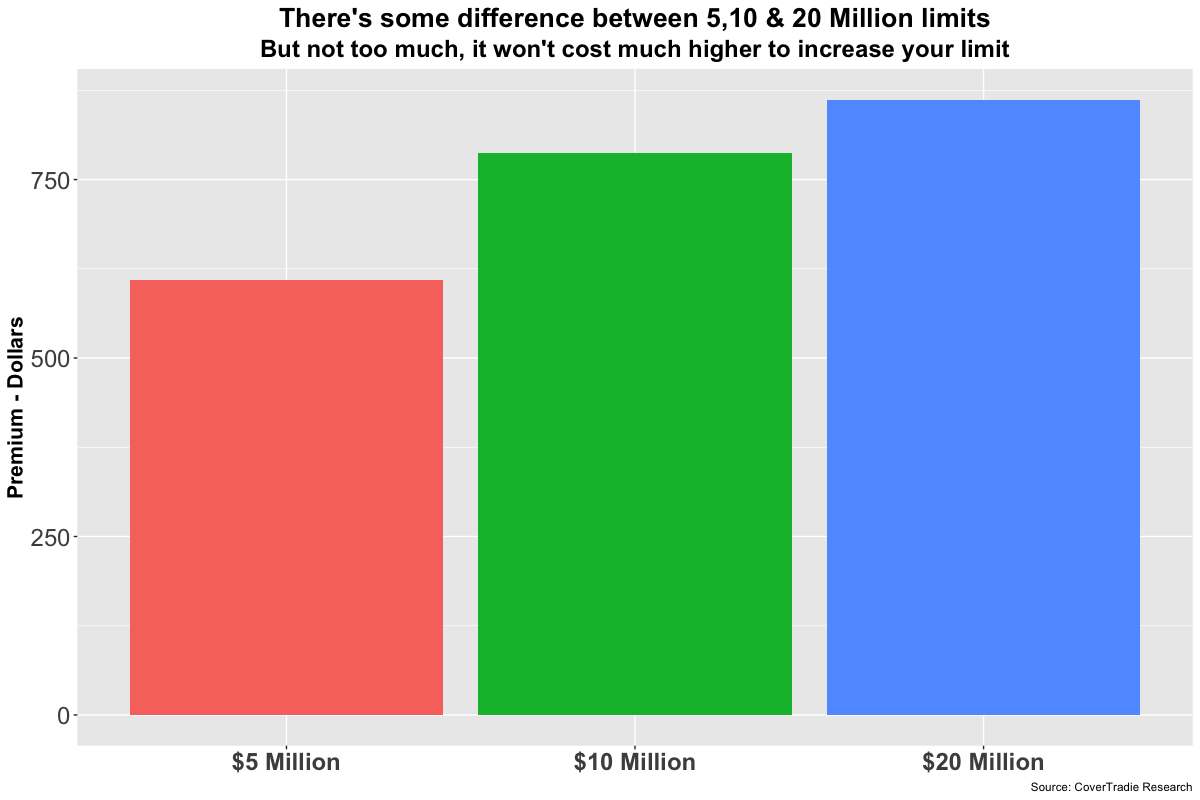

Up until now, our conversation has been centred around the $5 million limit for Electrical Contractors Insurance in QLD. Your requirement could be different.

If you are wondering is the cost of 10 million public liability insurance or cost of 20 million public liability insurance much higher than 5 million coverage?

It’s not uncommon that people need liability limit greater than $5Million. Not a big problem for Electricians.

There is some increase in premium with higher liability limits but it’s not too much.

| Limit | Lowest | Average | Highest |

| $5 Million | $ 609 | $ 887 | $ 1,251 |

| $10 Million | $ 787 | $ 935 | $ 1,070 |

| $20 Million | $ 862 | $ 1,085 | $ 1,351 |

That was just a high level view of Electrician insurance in QLD.

There are a lot of pricing options available in the market. And whilst the cost of insurance in QLD for Electricians is high, its certainly not as high as Plumbers in Victoria.

Having said that, it is still important to do proper research before you get your insurance. There are some insurers who see electricians as a high risk occupation and others who don’t.

There are some who offer better claims service than others. We can help with that. Give us a buzz and we’d love to sort out your insurance.

A knowledgable broker can make a difference and we think we know a thing or two about the tradies insurance market so give us a call and we’d be more than happy to sort out insurance for you.

Insurance Types

How much public liability insurance do I need?

The minimum coverage required usually is $5 Million dollars but there would be situations you may need $10 million, $20 million or more. This depends on who you work with, the complexity of your work.

If you work as a sub-contractor to a large business, they are most likely to ask for a $20 Million limit.