Many carpenters end up paying too much for their insurance because of one or more of the following reasons:

- Their broker didn’t know which insurer was offering the best price for their insurance

- They took advice from a mate who recommended someone

- Their bookkeeper put them on to their “insurance broking mate”

- Believed the furphy that all trades are a high risk and accepted high premiums are okay

- Got advice from a generalist and not a specialist in trades.

CoverTradie insights below will clarify what Carpenters Public Liability Insurance Costs should you be willing to pay based on the quotes we’ve observed from across the country.

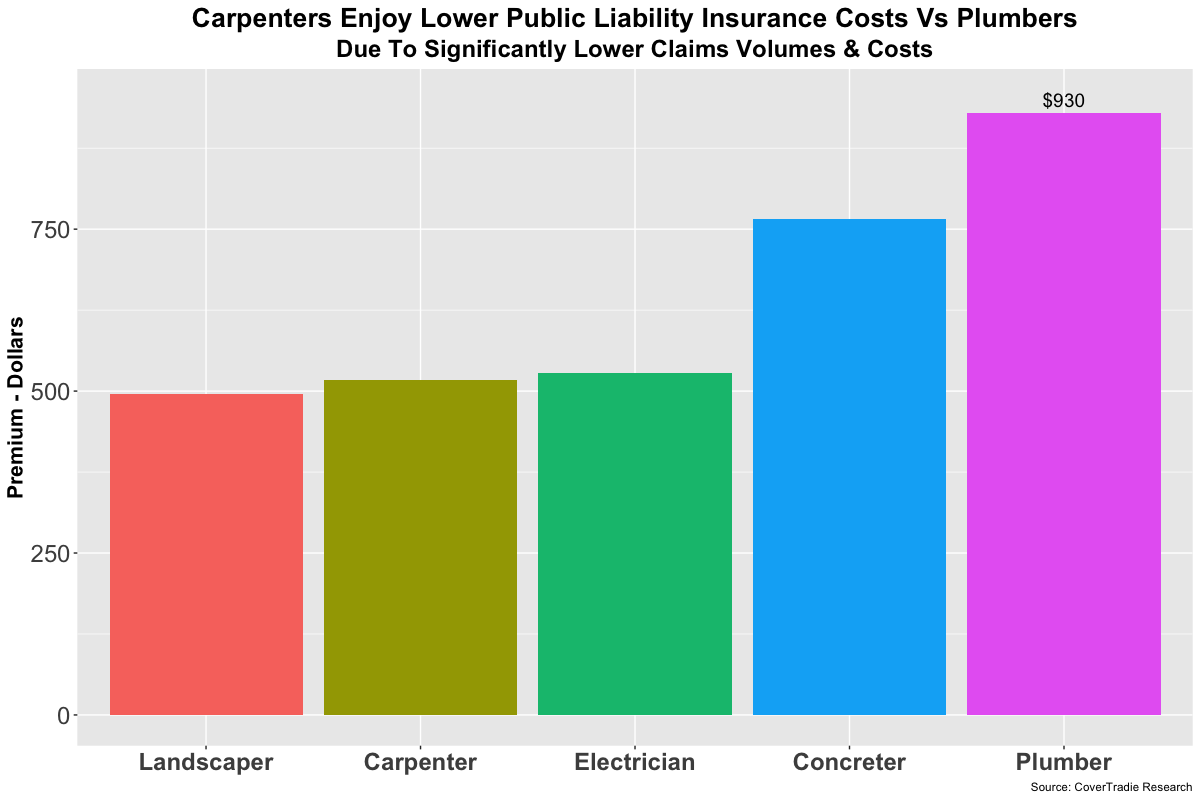

Carpenters Public Liability Insurance Cost is a lot lower than Plumbers & Concrete contractors. See below:

How much does Carpenters Public Liability Insurance Cost?

The cheapest premium we found for Carpenters Public Liability Insurance was $517. There is a large range of prices available in the market. The table below displays the variation in the cheapest, average and highest prices we observed.

| Category | Cost |

| Cheapest | $ 517 |

| Average | $ 717 |

| Highest | $ 1091 |

The difference between cheapest and highest price is more than 2 times. Even if you were happy with an average price, the cheaper price still saves $200.

Imagine how much more would you pay if your broker was not able to find the cheapest price but only something that was close average premium. You’d be paying a LOT! Let’s explore further.

Does the price change much from state to state?

The simple answer is no, there isn’t a whole lot of variation in pricing for carpenters insurance from state to state. Unlike other trades like Plumbers in Victoria pay nearly twice as much as plumbers in some other states.

Or Electricians in Queensland are a lot more expensive to cover compared to electricians in other states. Consumer protection legislation has an impact on sparkies and plumbers insurance there. But nothing much to report for carpenters.

The table below shows the cheapest, average and highest premiums for carpenters public liability insurance that we observed for a small business with $100,000 turnover.

| State | Cheapest | Average | Highest |

| QLD | $517 | $692 | $863 |

| VIC | $521 | $717 | $991 |

| WA | $521 | $679 | $871 |

| SA | $526 | $683 | $879 |

| NSW | $550 | $813 | $1,091 |

No matter what state you are in, there is opportunity to save if you are paying near the average premium, particularly in NSW & VIC.

Insurance Types

What happens to the price of insurance as your business grows?

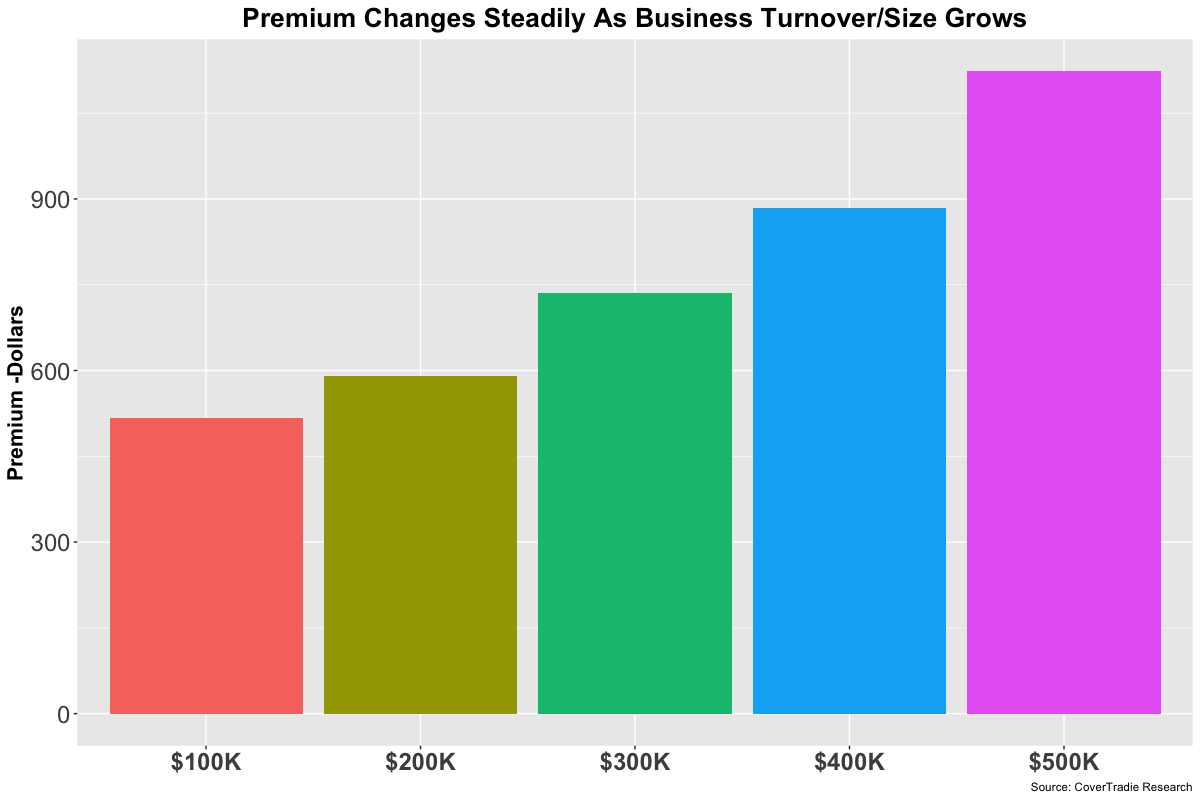

You may be curious to know what happens to your insurance prices as your business grows.

Well, Regardless of what state you work in, as the business grows, the risk of claims also increases. Insurers know that and hence they increase the premiums as your business grows. See chart below:

Why do insurers believe the risk increases as the business grows?

Now this could be due to you as a business owner getting super busy and getting caught up in too many things causing loss of focus that resulted in a claim.

For many business owners, it’s the apprentice supervision that is a problem. Its not uncommon to see the claims increase with increased number of staff and junior apprentices

The controls & risk management in a business that prevent claims and stuff-ups become strong over time. There is a period when they are weak which result in claims.

You can’t control what insurers think and how they price insurance. You can make a choice of insurer and your broker. That will save you money.

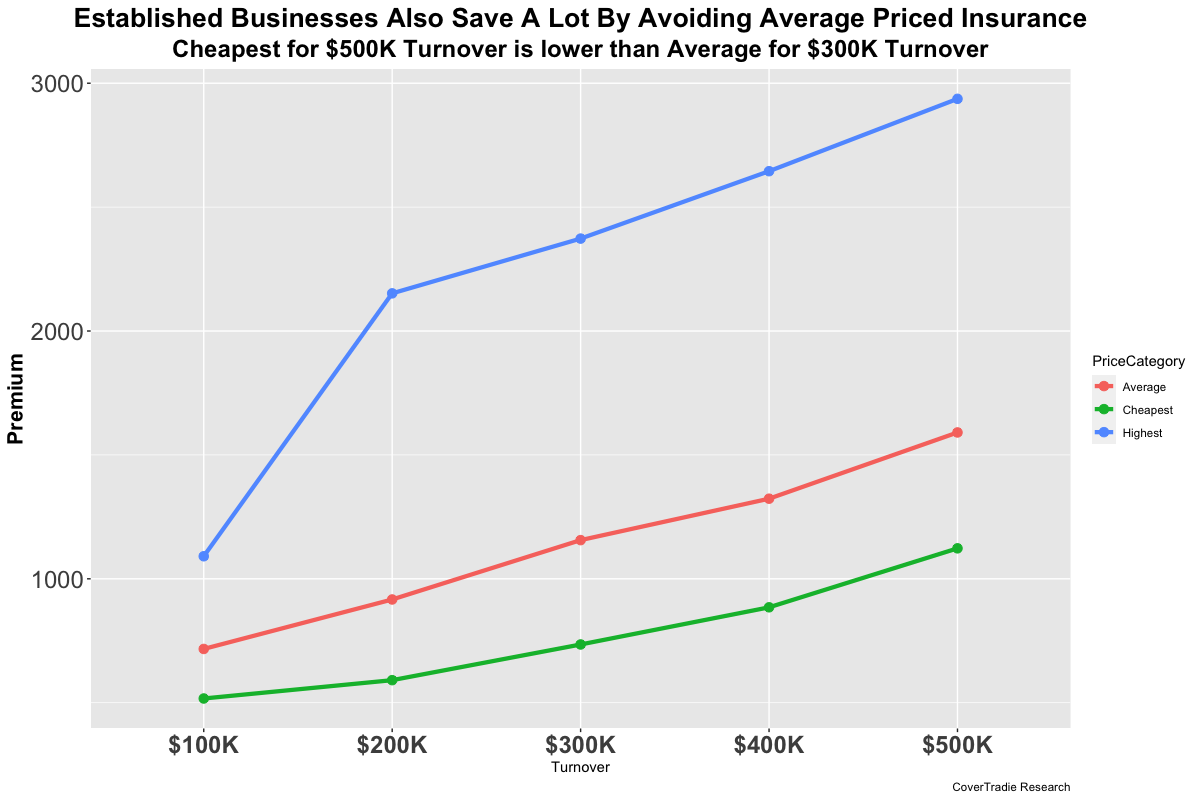

The importance of the above statement is further demonstrated by this chart below. It highlights that the cheapest polices save a lot of money in the long term.

As your business grows, being on the cheapest policies will add even more to your bottom line. Notice how the premium of Cheapest Price Category at $400K turnover is lower than $200K turnover for the Average Price Category(redline).

In all, select a broker who knows what they are doing so they can help you get where you want to – FASTER.

CoverTradie is a specialist insurance broker for tradesmen. If we can be of help to you, please give us a call. If you found this article useful, please consider sharing it on Facebook to help us get the word out.

Insurance Types