Plumbers Public Liability Insurance Cost

Plumbers Public Liability Insurance policies can be expensive, with nasty exclusions and specific excesses that can affect coverage.

Making a wrong choice when getting insurance can result in significant losses that must be avoided.

With CoverTradie’s insights below on Plumbers Public Liability Insurance Cost.

You will be able to get an understanding of how prices track for your trade and make an informed decision.

Avoid getting ripped off by someone intentionally or accidentally.

How much does Plumbers Public Liability Insurance Cost?

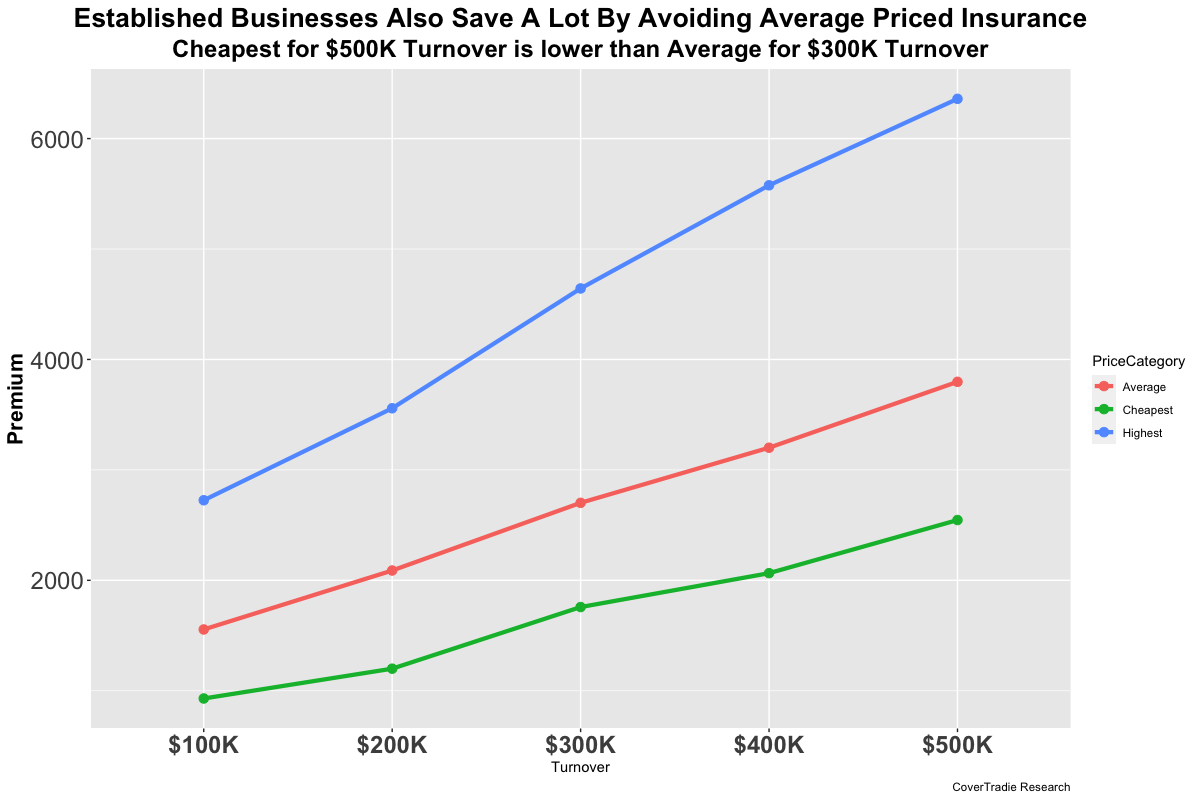

There are a large number of prices available in the market. Some insurers see Plumbers as very high risk so they price them high, others not so much. The table below displays the huge variation in the cheapest, average and highest prices we observed. See below:

| Category | Cost |

| Cheapest | $ 930 |

| Average | $ 1,672 |

| Highest | $ 2,750 |

Knowing which insurers price plumbing businesses favourably is very important.

Imagine how much more would you pay if your broker was not able to find the cheapest price but only something that was close to average premium. You’d be paying a LOT! Let’s explore further.

So where do you get this cheap plumber public liability insurance?

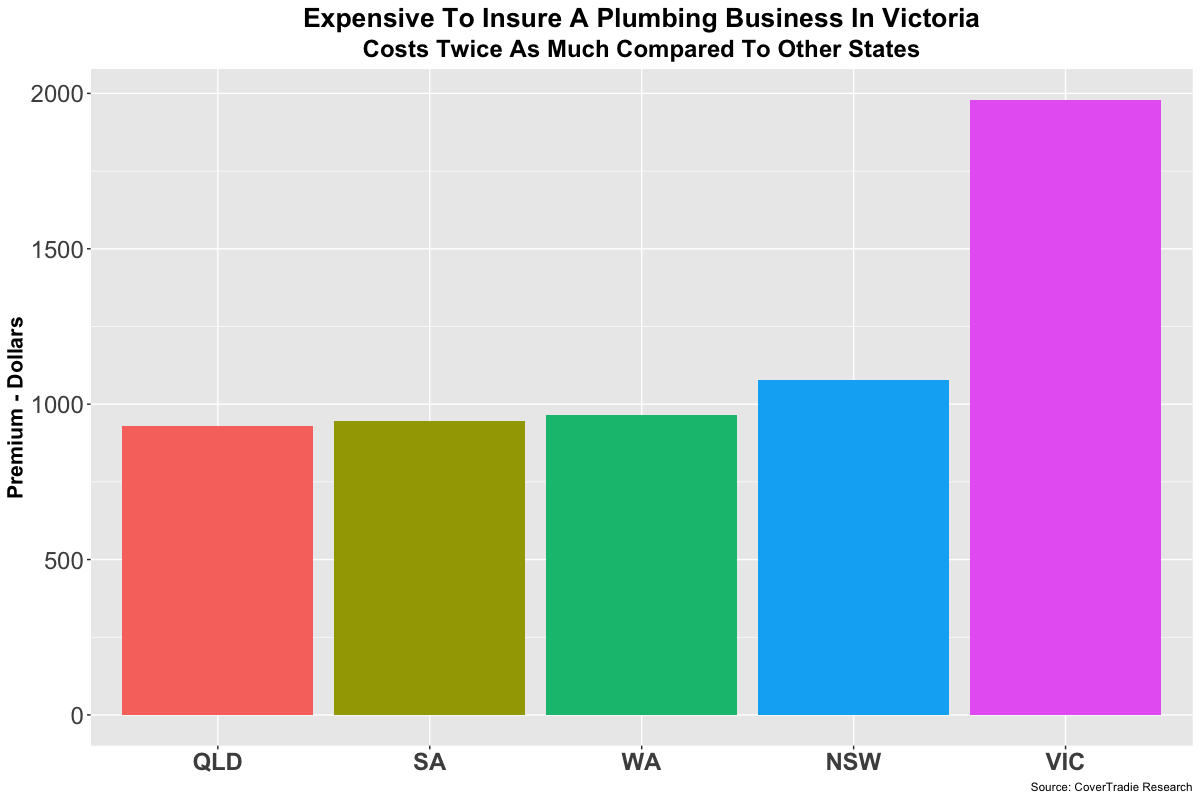

The cheapest price was in Queensland but you wouldn’t be surprised to know that prices vary a bit depending on what state you are in.

Sydney should be the most expensive isn’t it? Given everything else in Sydney is just more expensive like real estate, cost of living etc. then insurance should be too?

Not the case for Plumbers. Victoria is!

The cheapest price in Victoria was $1980 which is more than double the cheapest in Queensland.

Now some of that has got to do with market conditions like the cost of doing business in particular states or the volume of claims, the consumer protection legislations have a significant influence.

Victorian Plumbing legislation influences the insurance premiums significantly, where plumbers pay nearly twice as much compared to other states.

The table below displays Plumbers Liability Insurance Cost across different states in Australia at 3 different classifications i.e. the cheapest, average & the highest premiums.

| State | Cheapest | Average | Highest |

| Queensland | $ 930 | $ 1,555 | $ 2,725 |

| South Australia | $ 946 | $ 1,446 | $ 2,120 |

| Western Australia | $ 965 | $ 1,452 | $ 2,348 |

| New South Wales | $ 1,077 | $ 1,795 | $ 2,712 |

| Victoria | $ 1,980 | $ 2,283 | $ 2,750 |

Source: CoverTradie Research

With knowledge, its easy to save $500-$600 dollars by moving from an average price to a cheaper price and more saving if you are on a higher end price.

Insurance Types

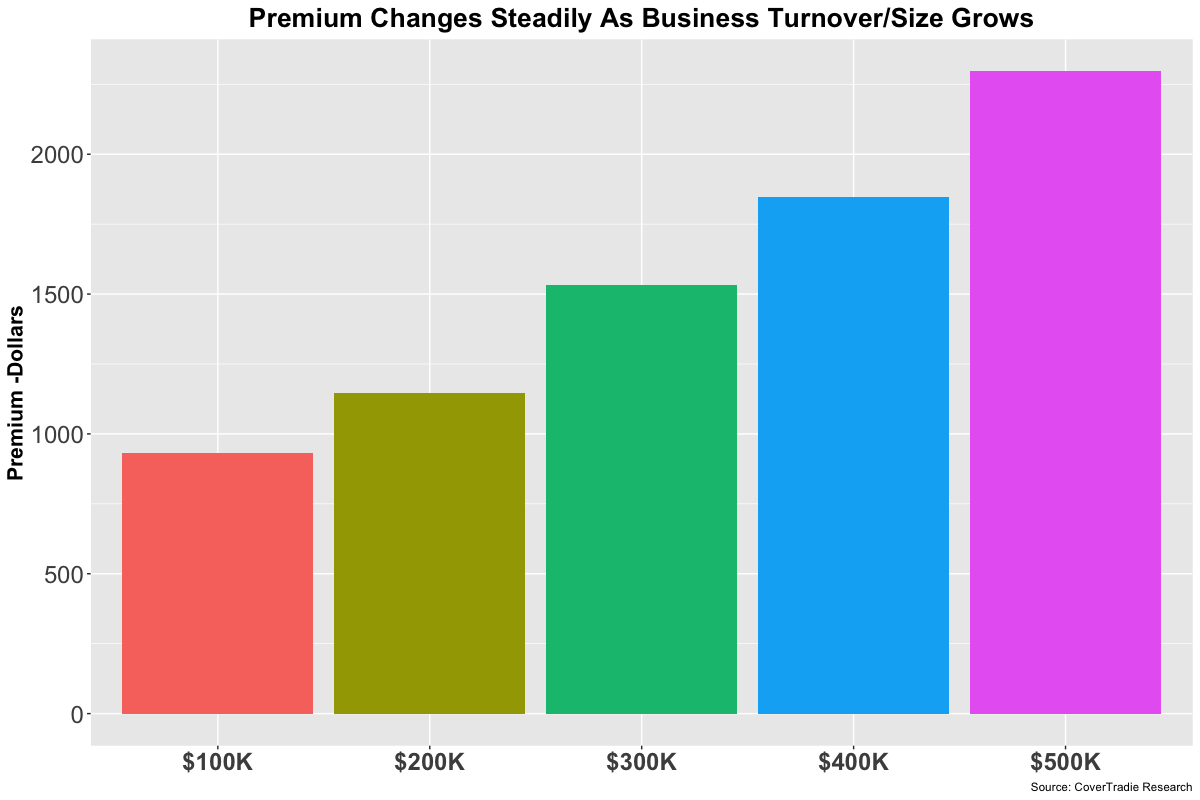

What happens to the price of insurance as your business grows?

Regardless of what state you work in, as the business grows, the risk of claims also increases. Insurers know that and hence they increase the premiums as your business grows. See chart below:

Why do insurers believe the risk increases as the business grows?

Now this could be due to you as a business owner getting super busy and getting caught up in too many things causing loss of focus that resulted in a claim.

For many business owners, it’s the apprentice supervision that is a problem. Its not uncommon to see the claims increase with increased number of staff and junior apprentices.

The controls & risk management in a business that prevent claims and stuff-ups become strong over time. There is a period when they are weak which result in claims.

You can’t control what insurers think and how they price insurance. You can make a choice of insurer and your broker. That will save you money.

The importance of the above statement is further demonstrated by this chart below. It highlights that the cheapest polices save a lot of money in the long term.

As your business grows, being on the cheapest policies will add even more to your bottom line. Notice how the premium of Cheapest Price Category at $400K turnover is the same as $200K turnover for the Average Price Category(redline).

In all, select a broker who knows what they are doing so they can help you get where you want to – FASTER.

CoverTradie is a specialist insurance broker for tradesmen. If we can be of help to you, please give us a call. If you found this article useful, please consider sharing it on Facebook to help us get the word out.

Insurance Types

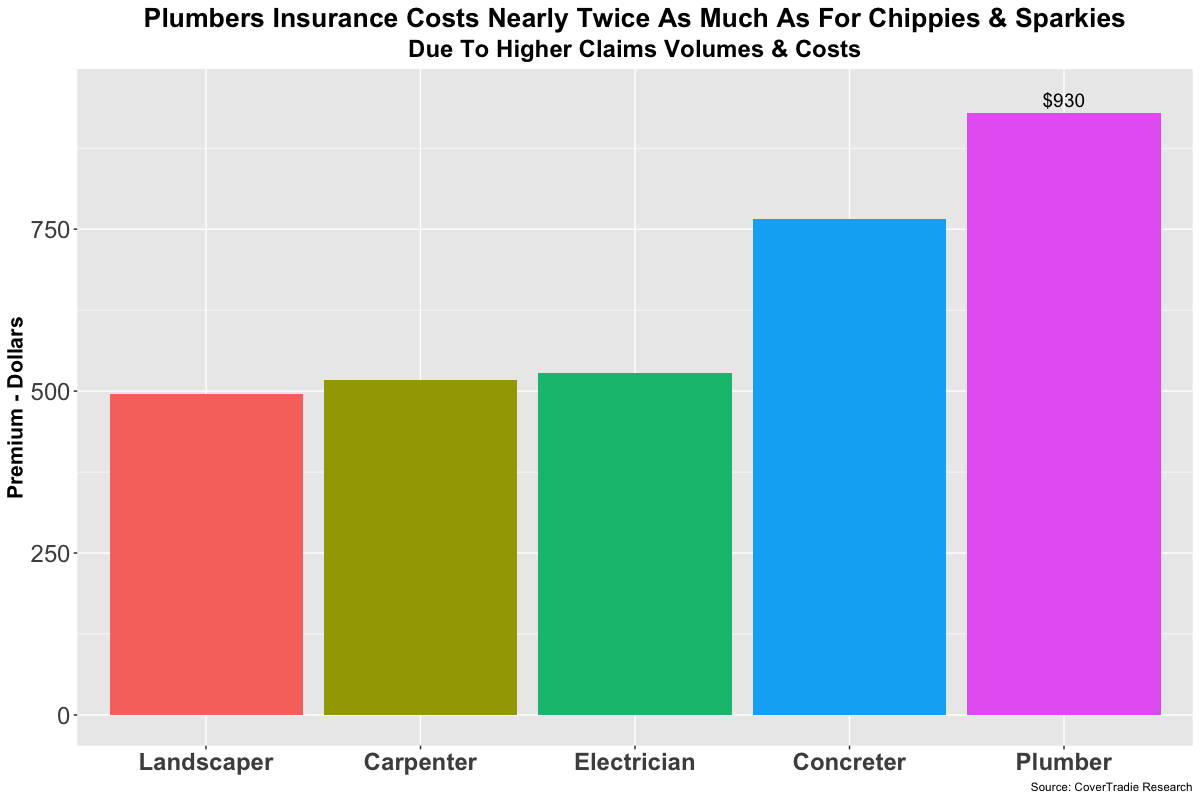

Why is Plumbers Public Liability Insurance Cost so high?

Dealing with fluids whether liquid or gas which both have the tendency to escape results in damages which causes higher volume of claims.

The more frequent the claims and severe the losses that result from those claims, the higher the cost to fix the issues and then results in higher price. Insurers by law have to collect enough premiums so that they are able to pay the claims hence why the pricing is significantly higher than other trades.

Which insurer offers the best Public Liability Insurance for Plumbers?

This one is a very subjective question. Is it best in terms of price, coverage or claims service. Where there is no variation in the policy coverage, obviously the lower the price the better it is for the customer.

CoverTradie always finds you the cheapest deal unless there is serious service issues from the insurer perspective that we may have experienced.

Every broker will have a different experience with different insurers that why you often hear them say “This insurer pays the claims.” It is important to note though that all insurers have to abide by the rules set by AFCA for any disputes that arise, which means that if there is a dispute and the policy wording has to cover a claim, insurers can’t get away with it. As you broker, we act as the go between anyway. We keep them honest. That’s our job.

Can I pay my policy by the month?

Yes, with CoverTradie you can pay by the month. Give us a call.